Gold — along with just about every other investment sector — sold off in the wake of the last Fed meeting. It’s the greatest fool phenomenon in action, but we don’t have to acquiesce and join the parade of fools. The record shows that things even out over the longer term, writes Brien Lundin, editor of Gold Newsletter.

It wasn’t so bad after the Fed’s policy statement was released, nor during much of Chairman Powell’s subsequent press conference. But then came a question as to the timing of the first rate cut, to which Powell replied:

“Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that (a rate cut).”

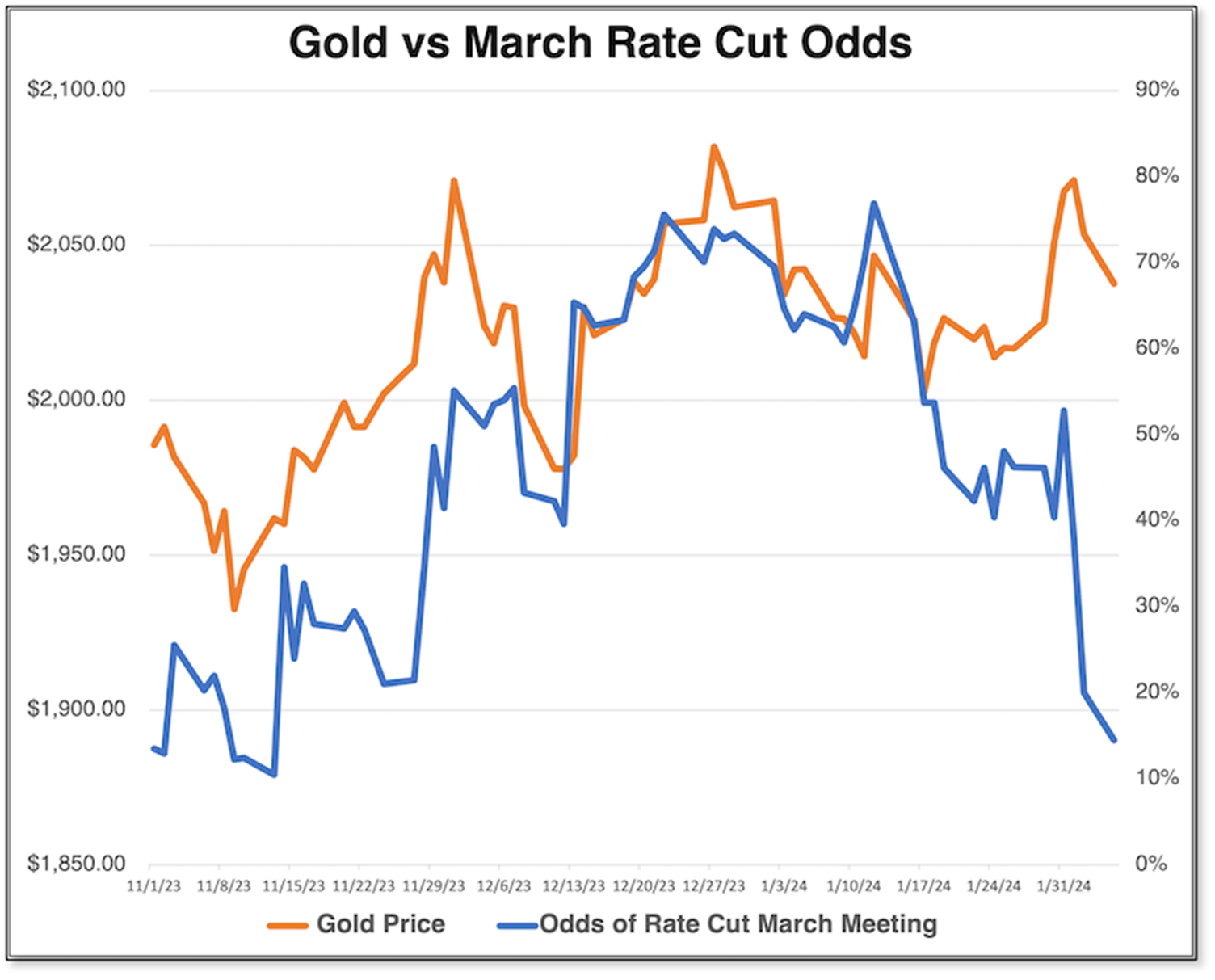

And so the sell-off began. Then, in an interview on “60 Minutes” Sunday evening, he repeated that statement even more forcefully. And so the sell-off continued. I featured the following chart in our February issue of Gold Newsletter, and recently updated it.

As you can see, over the last few months gold has risen and fallen along with investor expectations that the Fed pivot would begin in March. The correlation weakened a little last week as US retaliatory strikes on Iranian-sponsored militia groups sparked some gold buying, but the connection remains the same.

That said, all of this short-term hand wringing and insane focus on every word uttered by any Fed official is ridiculous. I only report on it because gold is, unfortunately, caught up in all of it.

And not in a good way: The obsession with Fed policy has resulted in the weird calculation of current markets that high inflation is actually bearish for gold. It is so, the logic goes, because hotter inflation numbers will lead the Fed toward more-hawkish stances.

Never mind the relationship that has held throughout thousands of years of human history: That gold protects against the ravages of monetary inflation. Asset values today aren’t established by thoughtful, longer-term investment decisions, but rather by bets on what’s going to move the next day, hour, or even minute.

But I believe history argues for an exceptional performance once the cycle turns toward rate cutting. Whether that cycle begins in March or May will matter little in the long run. We know it’s coming...and we know we’ll want to be in gold, silver and mining stocks once it begins.

Recommended Action: Buy gold.