Whereas two weeks ago markets were driven more by macro factors, the focus last week was on the earnings deluge, with tons of leaders and potential leaders reporting. Most indexes were up modestly (0.5% to 1.5%) on the week, led by the Nasdaq, with the broader indexes again lagging a bit. I like Intra-Cellular Therapies (ITCI), which had a very nice November/December run, explains Mike Cintolo, editor of Cabot Top Ten Trader.

Despite the week-to-week change in market focus, not much has changed with the market’s positioning. When looking at the primary evidence, it remains clearly positive. The intermediate-term trend of the major indexes is pointing up (even the weakest index, the S&P 600 SmallCap, is more neutral than negative) and the action of leading stocks is very buoyant, with many extending higher and with more gapping up hugely on earnings. Thus, overall, we remain bullish—we’re leaving our Market Monitor at a level 7.

That said, the same things to watch we wrote about two weeks ago are hanging around, the first being that most of the market continues to meander sideways. To be fair, this divergence is more about concentrated buying (in the leaders) rather than broadening selling pressures (new lows are still under control). But it does raise the risk of some character change in the days/weeks ahead.

Plus, there’s little doubt things are becoming near-term frothy, with many exaggerated moves higher, including some after earnings. And finally, the trend of interest rates is looking iffy here, with both five- and 10-year Treasury yields cracking intermediate-term support (50-day lines and recent highs).

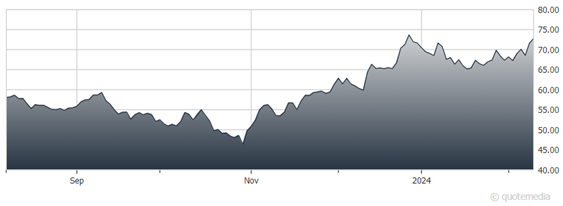

Intra-Cellular Therapies (ITCI)

To be clear, up is good — big “up” moves on earnings and things remaining “overbought” are hallmarks of bull markets. And after the last couple of years, where trends would last a few weeks at best before rolling over, we’re enjoying the run.

But it’s best to pay attention to all of the evidence out there, which today means (a) riding most of your winners higher as long as they act well, but also (b) taking some partial profits on the way up and (c) looking to buy fresher names at high-odds entry points.

ITCI, like many biotechs (and non-tech names), has spent the past few weeks building a launching pad. And after testing its 50-day line, it has begun to bounce. We’re okay starting a position here with a stop just under 65. Earnings are due out February 22 and there is event risk (clinical trial results) as well, just FYI.

Recommended Action: Buy ITCI.