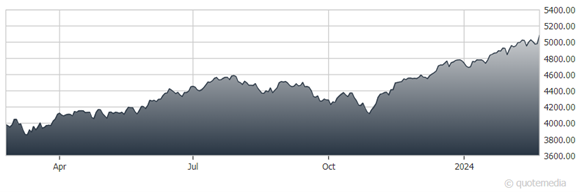

The S&P 500 surged to all-time highs last week above 5,100, thanks primarily to the Nvidia (NVDA) earnings explosion. With last week’s gains, the S&P 500 has now rallied more than 25% since the October lows in just over four months. Certainly, that is impressive and very beneficial for our accounts. But let’s talk about what to expect NEXT, notes Jim Woods, editor of The Deep Woods.

The rally broadly has been justified by hopes of Fed rate cuts, falling bond yields, declining inflation, Goldilocks growth, and momentum.

S&P 500

But at 5,100, the S&P 500 is now trading nearly 22X forward earnings, a multiple previously only reserved for periods of QE and 0% rates, not QT and 5.37% fed funds. So, as the march higher continues, let’s step back and look at the change in fundamental factors that has fueled this rally so we can gauge where we are from a performance vs. fundamentals standpoint.

Factor 1: Dovish Fed expectations. In mid-October, the S&P 500 was threatening to break below 4,000 as yields screamed higher and amid fears the Fed would be higher for longer. However, that all changed with Fed commentary that implied inflation was set to drop sharply and that, in turn, would lead to a less-hawkish Fed.

The market took those sentiments and ran with them, as expectations for rate cuts in 2024 exploded from just two expected cuts in October to seven expected cuts by December! However, so far this year, those expectations have been substantially reversed. Rate cut expectations have dropped back to around four for this year and all the while, fed funds has remained unchanged since October at 5.375%.

Factor 2: Yields. On Oct. 19, the 10-year Treasury yield hit (essentially) 5%. Over the next three months, pressured by extreme dovish Fed expectations, the 10-year crashed lower to below 4%. Since then, the 10-year has rebounded to 4.25% and it’s threatening to break out of the 3.75%-4.25% trading range it’s inhabited for the past several months.

Factor 3: Declining inflation. Inflation has fallen sharply from the highs of over 5% in May to around 4% in October (using Core CPI as the metric). But since then, inflation has been flat as core CPI is still sitting, essentially, at 4% year-over-year. The Core PCE Price Index has fared slightly better with year-over-year inflation declining from 3.39% to 2.93%.

Factor 4: Earnings. Back in October, markets expected 2024 S&P 500 EPS to be between $245-$250 per share, far above the $225 per share in 2023. But since October, earnings expectations have declined to around $243 per share. Yes, it’s still solid earnings growth, but not quite as great as expected.

Factor 5: Goldilocks economic growth. Economic data has continued to point towards a “No Landing”/“Soft Landing” scenario. The labor market remains very strong while there have been only some hints of weakness from the consumer (credit card default rates, soft January retail sales).

Here’s the point of this analysis: The fact that stocks have rallied since October makes sense. The Fed will cut. It’s just a question of when. Yields have fallen sharply, allowing multiple expansion, while inflation has continued to (slightly) decline and growth has remained resilient.

However, if we look at the facts, I cannot help but feel as though this relentless rally has gone far beyond either actual improvement in the fundamentals and reasonable expectations of continued improvement.

Put simply, at 22X earnings, this market is pricing in perfection. While there’s absolutely been positive motion since October, I urge investors to view 5,100 in the S&P 500 as enjoyable, but extremely vulnerable to a sudden, potentially violent, reversal if the proverbial “music” stops in this game of financial musical chairs.