I recently attended a mining convention and I want to tell you about my experience on a panel there. I was one of five analysts on this panel, along with a very highly qualified moderator, and everyone was a brilliant expert in their own area. The key takeaway? If you’re not already prepared for a big move in gold, I urge you to get ready now, notes Brien Lundin, editor of Gold Newsletter.

I won’t share all the names because there isn’t a transcript and I can’t remember who precisely said what. But suffice it to say that I disagreed with a few of the points that others made. To wit:

- Silver is now mostly an industrial metal and has proven to be completely uncorrelated with gold

- Gold isn’t going to go anywhere until the stock market crashes or at least corrects significantly

- The industrial story — the rising demand for “battery metals” — is the biggest story right now and will be the big driver for silver

If you’ve been reading my commentaries for any length of time, you know I disagree strongly with all of these statements. And I wasn’t shy in saying so in the panel.

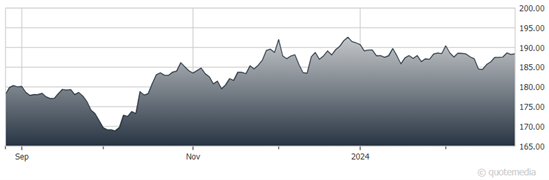

SPDR Gold Shares (GLD)

I shared my view that the monetary drivers are and will remain the biggest factors by far for gold and silver. I told the audience that we’re in the end game of a four-decade-plus trend of ever-easier money, and that the Fed’s next emergency move will be so dramatic that it will lift not only gold and silver, but also all risk assets (stocks included).

I think I made my point sufficiently well and the audience agreed with me.

Meanwhile, I also want to talk about a major new shift in global gold flows, one confirmed by one of my fellow panelists, Joe Cavatoni with the World Gold Council. You see, Western investors have been completely absent from today’s gold market. The holdings in the SPDR Gold Shares ETF (GLD), the biggest gold ETF, are plummeting and open interest on the Comex is at multi-year lows.

At the same time, withdrawals on the Shanghai Gold Exchange were at the second highest level in history last month. This is the best proxy we have for domestic gold demand in China, and it’s showing that they’re buying gold hand over fist right now.

This is highly unusual, because Asian gold demand has been historically price sensitive. These buyers typically come in strongly on big price declines.

That they are buying so eagerly speaks to the economic drivers in China right now, and their willingness to keep buying as the price increases. Conversely, when we get a real breakout in the gold price, the trend-following Western buyers will turbocharge the move.

We know that the Fed’s eventual pivot will spark the next move higher in gold. And all the evidence now points to this move being one of the most dramatic ever.

Recommended Action: Buy gold, GLD.