Man, the market is poised on the brink of a fantastic rally! That may run counter to what the doom-meisters are telling you. Let me show you why they’re wrong, why I’m right, and how you can play this with the Invesco Nasdaq 100 ETF (QQQM), says Sean Brodrick, editor at Weiss Ratings Daily.

First of all, the market had a couple of down days recently — but that’s AFTER the S&P 500 hit an all-time high and notched its 13th record close on Friday. Nothing travels in a straight line, so we’re seeing some giveback before the next thrust higher.

Could we be at a top? Not likely. Any year when the S&P 500 hits an all-time high, history shows it makes more all-time highs an average of 29 times!

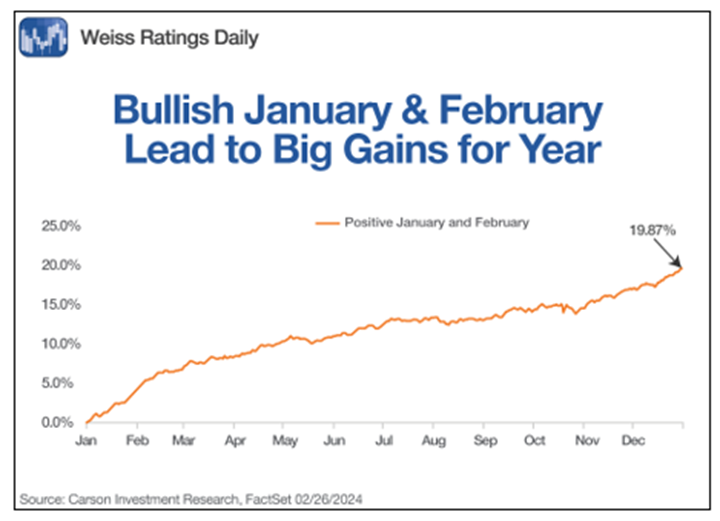

Want another fun fact? Since 1950, when both January and February are positive for the S&P 500, the average annual gain has historically been 19.87%, as this chart from Carson Research shows…

What’s more, a positive close this month would be the fourth month in a row — November, December, January, and February — that the S&P 500 has closed higher. The full calendar year has NEVER ended lower when that happens. It’s happened 14 times before, and the S&P 500 has ended higher all 14 times, up an average of 21.2%.

So, how can you profit in this market? In my Supercycle Investor, we’re playing this move with individual stocks — and already grabbing fat gains with both hands. There is a lot more to come. But if you want to buy an ETF, consider something tech-heavy. After all, AI is going to power tech higher.

You can buy the Invesco QQQ Trust (QQQ). But that’s a bit pricey, with an expense ratio of 0.2%. You can buy the same thing for much cheaper with a lower expense ratio — 0.15% — with QQQM. It has a Weiss Rating of “C” and is basically a cheaper version of the QQQ.

You can see that the tech-heavy QQQM is already ramping up. Despite the warnings from Wall Street’s doom-meisters, I believe it has a great year ahead of it, for all the reasons I told you and more. My target on QQQM is $260 per share.

Recommended Action: Buy QQQM.