Viking Therapeutics (VKTX) shares recently soared when it released excellent Phase 2 SubQ data for VK2735 (GLP-1/GIP) showing treated patients lost up to 14.7% of their body weight over 13 weeks, in a clean, dose-dependent manner with high statistical significance (p<0.0001). The primary endpoint win is a 13.1 percentage point reduction in weight compared to the placebo group, explains John McCamant, editor of The Medical Technology Stock Letter.

The GLP-1 receptor agonists are transforming the treatment of Type 2 diabetes (T2D) and obesity. The 11 approved GLP-1’s collectively achieved sales of $36.5 billion in 2023 making this group the largest drug class in the industry, with growth potential in excess of $100 billion.

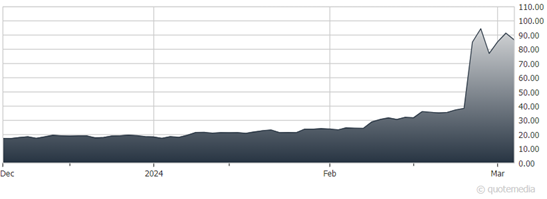

Viking Therapeutics (VKTX)

Regarding VKTX and its compound, by comparison, Eli Lilly & Co.’s (LLY) Zepbound resulted in a 7%-8% improvement over a placebo in the Phase 3 study (Surmount-1). Lilly’s retatrutide – which targets all three Gs – led to a 12%-13% weight loss versus placebo, however with more side effects than the Viking compound, including cardiovascular risk. Investors were led to expect a bar of just 8% placebo-adjusted weight loss for ‘2735 – which has now moved into position as a potential Best-in-Class drug.

One apparent advantage of the Viking compound is the potency and durability. It may be administered once-a-month, versus weekly or every other week for the current market leaders. In addition, another key catalyst to watch for by the end of Q1 is the oral version of ‘2735 with an expectation for a 1%-3% placebo-adjusted weight loss.

In our view, this Phase II SubQ data de-risks the upcoming Phase I data for ‘2735. Oral administration (i.e., a pill) is a huge advantage for the class – in particular as a long-term maintenance option.

Recommended Action: Buy VKTX.