Kinetik Holdings Inc. (KNTK) is an energy midstream company that was formed in February 2022 when publicly traded Altus Midstream merged with privately held EagleClaw Midstream. This created the only pure-play midstream company operating in the Texas Delaware Basin, notes Tim Plaehn, editor of The Dividend Hunter.

The Delaware is one of the more prolific production regions in the larger Permian Basin. The newly combined company has tremendous prospects for growth.

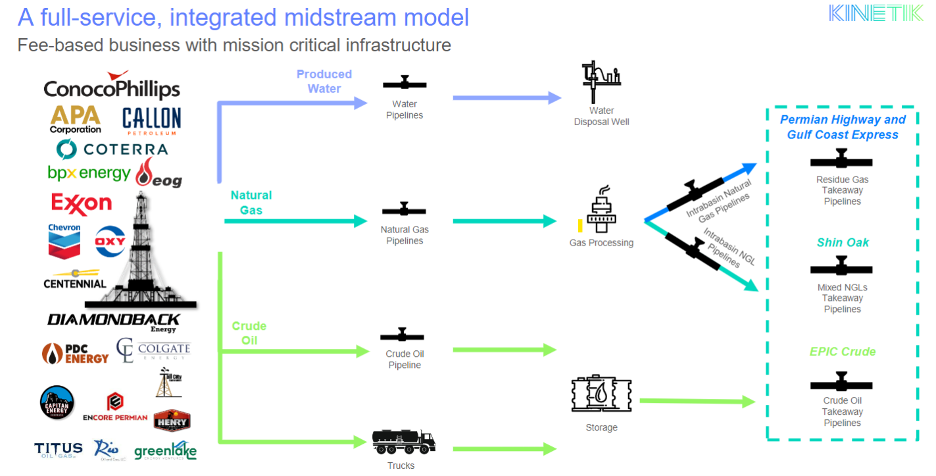

KNTK divides its business into two segments. Midstream Logistics operates water takeaway pipelines, natural gas pipelines, natural gas processing, crude oil gathering, and storage in the Delaware Basin. Pipeline Transportation operates natural gas, natural gas liquid (NGL), and crude oil pipelines to bring energy commodities out of the basin. This graphic provides an overview.

In Q4 2023, the midstream logistics of gathering water, gas, and oil from the wells generated 63% of EBITDA (earnings before interest, taxes, depreciation, and amortization). Pipeline transport chipped in the other 37%. For the 2023 fourth quarter, the company processed 1.54 billion cubic feet per day (cfpd) of natural gas, up from 1.2 billion processed in October 2022.

Q4 EBITDA was $228 million. The firm’s investor presentation stated it will generate 2024 EBITDA of $950 million to $980 million, up from $840 million last year.

The Delaware Basin is at capacity for natural gas and NGL processing. Bringing on new projects will take years. This is where KNTK stands out from the midstream crowd. Crude oil producers will see growing residual natural gas from their wells.

KNTK’s in-basin natural gas processing plant, the Diamond Cryo facility, is being upgraded to handle two billion cubic feet per day. As noted above, they processed 1.5 billion cfd in the fourth quarter. The company is also expanding capacity on two Basin-to-Gulf Coast pipelines.

KNTK has paid a $0.75 per share dividend for the last eight quarters. With capital expenditures down this year and EBITDA up, 2024 could be the year that KNTK announces its first dividend increase.

Recommended Action: Buy KNTK.