Financial advisors will often recommend clients allocate outside of the US by investing in non-US stock markets. This can potentially help investors better diversify their portfolios. But even if you only invest in US stocks, it doesn’t mean you’re not exposed to overseas economies. Plus, the US market is performing best, notes Sam Ro, editor of TKer.co.

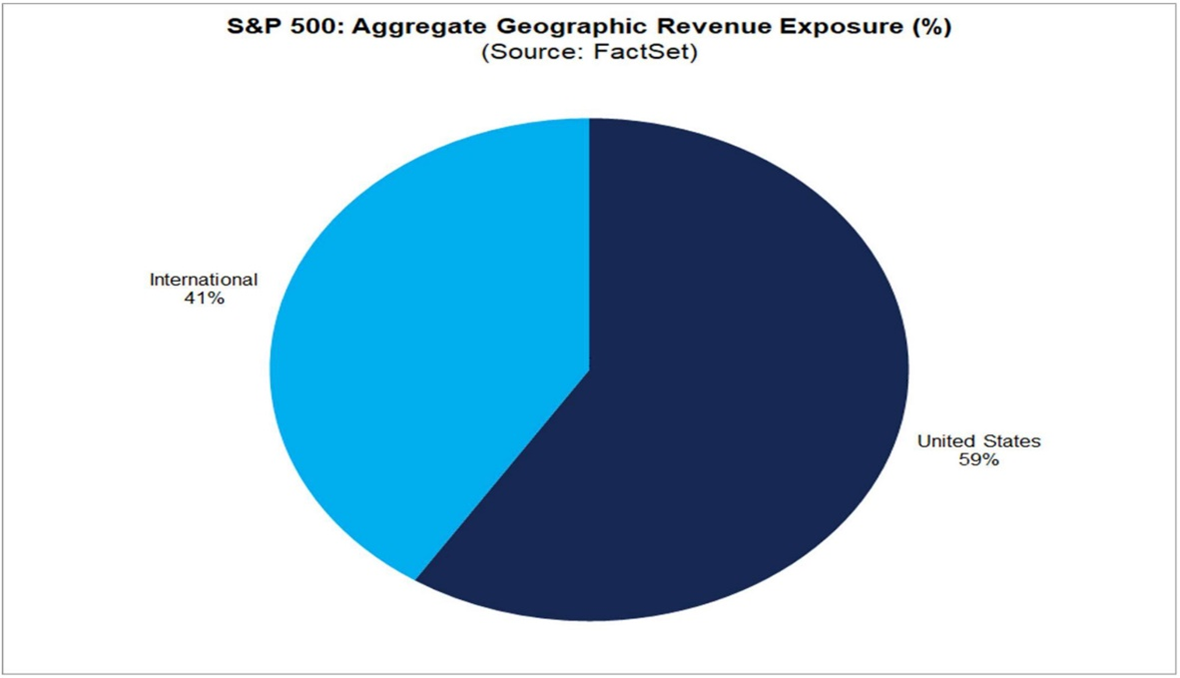

Understand that the US stock market includes many multinational corporations that conduct a lot of business abroad. According to FactSet, 41% of revenue generated by S&P 500 companies comes from international markets.

Sure, we’re only talking about the S&P 500 here. But the combined market cap of these companies represents a little over 80% of the market cap of all publicly traded US stocks.

Of course, many large non-US companies sell lots of goods and services to US customers, too. That means investing in non-US stocks also indirectly gets you some exposure to the US economy.

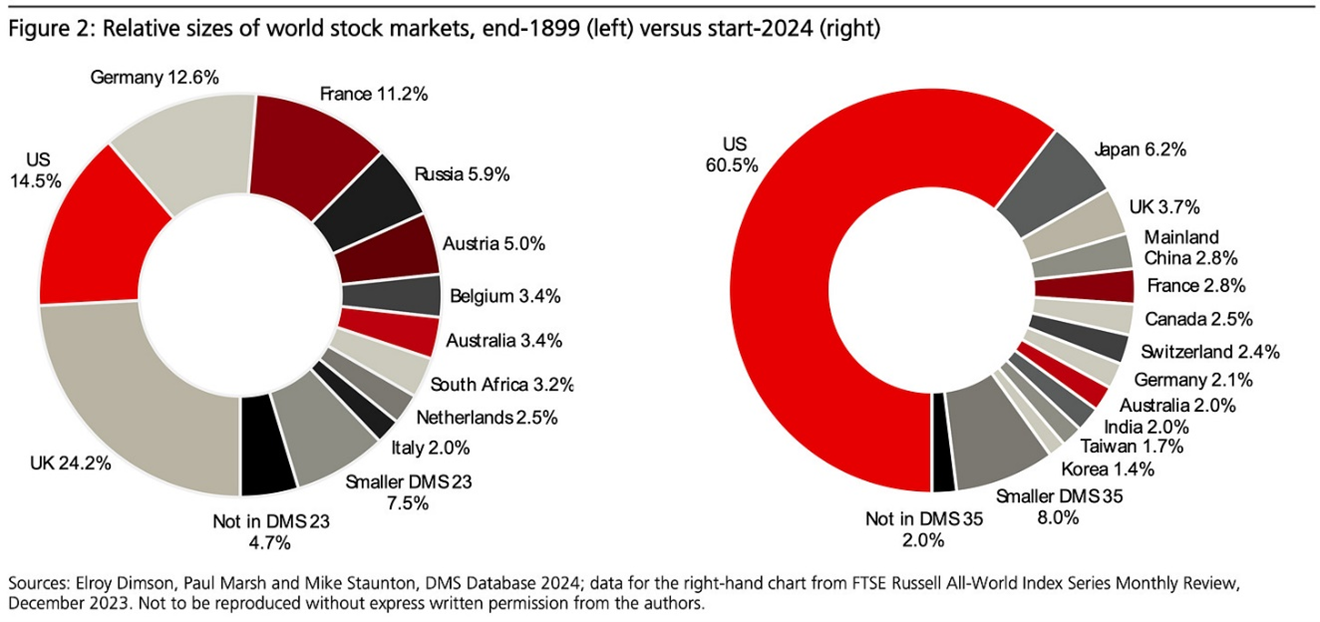

None of this is to say there aren’t great opportunities for investors in non-US stock markets from time to time. The chart below from UBS is a good illustration of this. It shows how the share of the world stock market’s value shifts across regions over time.

During the periods when the US (in red) was expanding, it was growing as a share of the world market, which implies that its market was outperforming the rest of the world. When the US was contracting, it was underperforming the rest of the world, which means investors could’ve benefited from having greater exposure to non-US markets during these periods.

There’s much more to be said about investing in companies based outside of the US. But for the purposes of this discussion, the bottom line is that you’re already getting lots of exposure to international companies by investing in US-based stocks in the S&P 500.

Plus, there’s clearly something special going on right now in the US that helps explain why our stock market has performed so well on the global stage. Maybe it’s the culture of innovation. Maybe it’s the business-friendly regulation. Maybe it’s the relatively strong corporate governance practices. Maybe it’s how shareholders incentivize company executives and employees.

Whatever it is, it’s helping to drive earnings higher. As a result, investing in the US stock market has been a winning trade for a long time, and there’s little reason to believe it won’t continue to be in the years to come.