FS KKR Capital Corp. (FSK) is one of the largest publicly traded Business Development Companies (BDCs). It focuses on loans to upper-middle-market US companies, primarily in the form of senior secured debt at high rates of interest, notes Tom Hutchinson, editor of Cabot Income Advisor.

As a BDC, FS KKR operates in the realm of private equity. Private equity is money provided to young and growing businesses that otherwise wouldn’t have access to sufficient capital. This money is typically lent at very high rates of interest and/or in exchange for equity stakes (a percentage of ownership).

Growing businesses with big ambitions need large amounts of capital in order to expand and grow to the next level. But such enterprises often have difficulty getting sizable enough loans from risk-averse banks, and they are too small to access the capital markets by issuing stocks or bonds. Thus, firms with the expertise to evaluate the risks can lend money at very favorable terms for themselves.

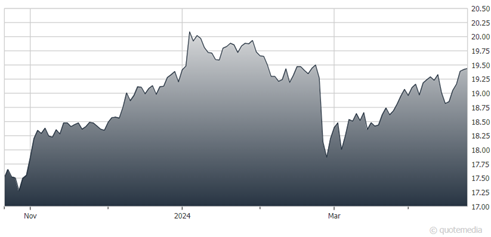

FS KKR Capital Corp. (FSK)

Middle-market companies are defined as those having annual revenues of between $10 million and $2.5 billion. FSK focuses on more established companies at the higher end of that range.

These smaller companies tend to be very cyclical. That can be good and bad. Smaller companies and BDCs typically do not perform well in an economic downturn. Right now, the economy looks solid and most institutions as well as the Federal Reserve have raised their projections for GDP in 2024.

FSK is a BDC with ties to the parent company KKR & Co. (KKR) from which it can leverage the pseudo-drop-down opportunities. FSK is one of the larger BDCs and scale matters in private equity. BDCs are still a relatively obscure sector, but the biggest ones tend to get a lot more investor attention.

FSK currently has a portfolio of 204 companies spread across 24 different industries. The concentration in the top 10 companies is 19%. The loans are primarily senior secured debt (65.7% in the first quarter). Rising interest rates don’t bother the business at all because 89.3% of loans are floating rate and only 10.7% are fixed rate. Higher interest rates mean more income. The average loan rate FSK collects from its portfolio is 12.2% as of the end of the first quarter.

This security is all about the dividend. It paid a massive 14.4% yield at the recent price. Therefore, the main question is: “How safe is this monstrosity of a payout?”

FSK pays nearly all of its cash flow in dividends and has developed a solid track record of maintaining and raising the payout. The dividend was cut during the pandemic from $0.76 per share to $0.60. That was an extreme situation. But the company may have trouble maintaining that payout in a recession. In the first quarter, the dividend was covered 107% with net interest income. It has covered the last four dividends by an average rate of about 111%.

Recommended Action: Buy FSK.