There is no magic in investing. While everyone is out there chasing magic and impossible dreams, there are some of us who show up to work every day and focus on buying quality businesses. I like NexPoint Residential Trust Inc. (NXRT) here, says Tim Melvin, editor of Takeover Letter.

There is always volatility. Prices will go up. They will go down. Making money in stocks, bonds, real estate, or anything else with a quoted price and intrinsic value is a variation on the same theme. Buy undervalued stuff and sell it when it is overvalued.

More often than not, a larger competitor or private equity fund will show up to take something off your hands before it reaches stupid levels. Either one of these outcomes will pay you outsized profits.

Sometimes, there will be lots of opportunities to buy undervalued companies with strong credit profiles. That usually happens in a bear market environment, when leveraged buyers puke up stocks all over midtown Manhattan, and everyone you know curses the idea of ever owning a single stock share again.

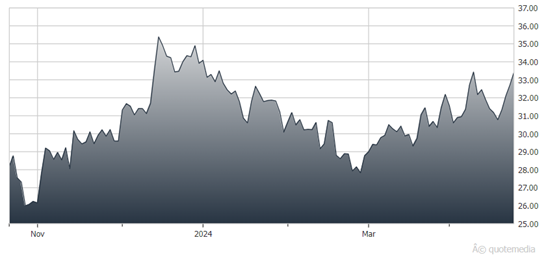

NexPoint Residential Trust Inc. (NXRT)

At other times, there will be few opportunities to buy undervalued companies with excellent fundamentals. Usually, this happens when stocks go through the roof and everyone loves stocks.

Maximizing the opportunities that exist in the stock market involve learning to be a trend follower who rides the trends with lots of leverage and strict risk controls or a total contrarian who buys fear and sells greed. Both are hard to do, and most people are looking for some magical, easy path to low-risk profits.

Here at the takeover letter, we prefer the contrarian approach. It is a better intellectual fit and involves less trading and leverage for what has historically yielded similar returns over time. It also leaves much more time for reading good books, watching baseball, and hanging out with granddaughters.

The closest thing to magic that you will find in investing is the elixir of undervalued companies, strong credit, and time. And that brings me to NXRT.

Blackstone has fired the cannon to start the M&A wave in commercial real estate and apartments. As Blackstone President Jon Gary recently put it, “The perception is so negative and yet the value decline has occurred, so when you get into this bottoming period, that’s when you want to move.”

Recommended Action: Buy NXRT.