The US stock market indexes climbed the wall of worry to new all-time highs this week as investors and traders took advantage of the growing number of breakouts across various sectors. Notably, Stocktwits community sentiment for the major indexes shifted into bearish territory, highlights Tom Bruni, head of market research at The Daily Rip by Stocktwits.

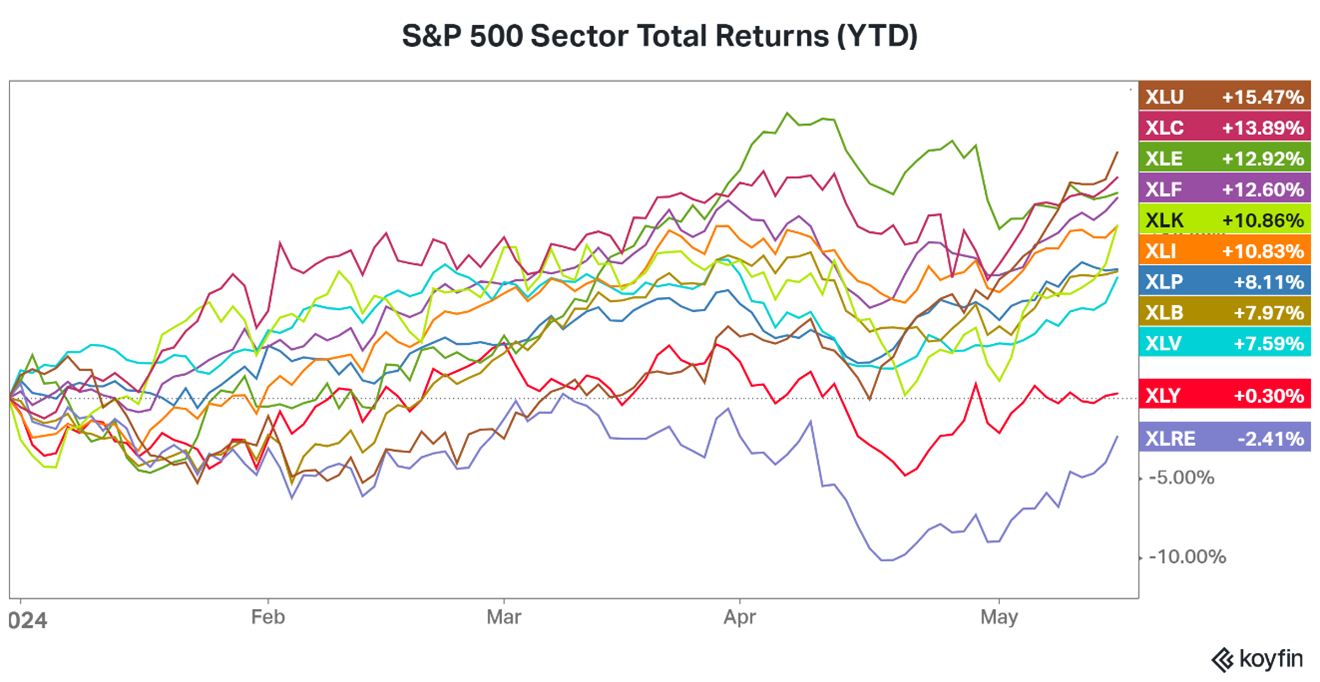

With the S&P 500 and Nasdaq 100 continuing to lead the way higher with double-digit YTD returns, it’s worth pointing out that the top sector in the market is not what many would expect. The chart below shows that utility stocks are actually outperforming everything else, followed closely by communication services and energy. Technology is certainly still up there, but the chart shows a broadening out of participation in the market that stock bulls have been looking for.

As for asset class returns, stocks continue to perform well, specifically international stocks that have lagged for much of the last decade. Indexes like the Nikkei 225 and Euro Stoxx 50 have less tech exposure and more cyclical stocks, which explains why they’re outperforming US indexes lately.

Outside of that, bonds continue to struggle, while certain commodities like cocoa and orange juice deliver outsized returns due to supply issues. Notably, base and precious metals are also performing well and remain the recent standouts in the commodity space.

Clearly, the current market environment is similar – but in some ways, different – from last year’s. More stocks, sectors, and assets are participating in the current rally, which is why many believe the current push to new all-time highs has legs.

Time will tell if they’re right. But we’ll revisit the charts in a few weeks as we examine the seasonal phenomenon of “sell in May and go away.”