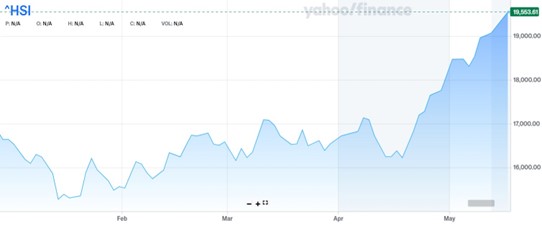

Chinese property stocks rallied last week because there was an official announcement of what was speculated recently – namely, that local governments were going to start buying some of the unsold residential real estate developer apartment inventory, partly financed by central bank lending. We remain bullish and long some stocks in Hong Kong where the Hang Seng is now up 14.7% year to date, notes Peter Boockvar, editor of The Boock Report.

Not only that, but the People’s Bank Of China (PBOC) also lowered the downpayment requirements for first and second homes nationwide to 15% and 25%, respectively, from 20% and 30%.

Hang Seng Index

Source: Yahoo Finance

After a few years into this property bubble unwind and distress for many builders, the Chinese authorities are now ripping the band aid off. These steps should go a long way in both stabilizing this very important industry for them and giving a lift to other parts of the economy, especially consumer spending.

That is because there is so much wealth tied up in property and that has taken a mark-to-market hit with the drop in home prices. The Hang Seng property index jumped another 2.5% last Friday and the Mainland properties index was higher by 5.3% after rising by 4.9% Thursday.

China also reported some mixed April data with retail sales softer than expected, but industrial production surprising to the upside. Home prices continued to fall in April, but the steps mentioned above should stem this.