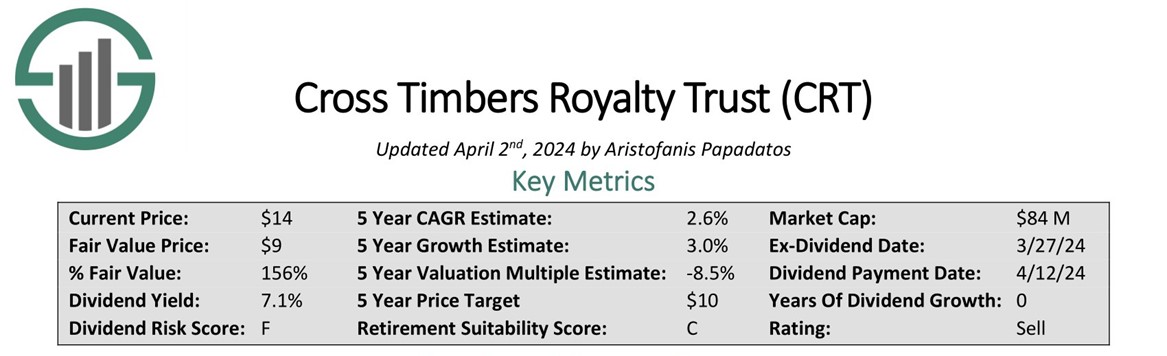

Oil and gas royalty trusts are now offering exceptionally high distributions to their investors, resulting in much higher yields than the 1.6% average dividend yield of the S&P 500. One worth highlighting is Cross Timbers Royalty Trust (CRT), with a recent dividend yield of 7.3%, says Bob Ciura, contributing editor at Sure Dividend.

Cross Timbers Royalty Trust is an oil and gas trust (about 50/50), set up in 1991 by XTO Energy. Its unitholders have a 90% net profit interest in producing properties in Texas, Oklahoma, and New Mexico; and a 75% net profit interest in working interest properties in Texas and Oklahoma.

In early April, CRT reported results for the fourth quarter of fiscal 2023. Oil and gas volumes grew 43% and 27%, respectively, over the prior year’s quarter thanks to timing of sales.

However, the average realized prices of oil and gas declined 10% and 56% versus blowout levels in the prior year’s period amid the core of the global energy crisis. As a result, distributable cash flow (DCF) per unit decreased 14%.

Recommended Action: Buy CRT.