As someone who has followed the markets for a very long time and learned from many of the smartest investors to play the game, I’ve learned that one thing you never do is say these words: “This time is different.” But I’m saying it now. The current gold market is like nothing we’ve seen before, with different drivers and different results, counsels Brien Lundin, editor of Gold Newsletter.

Don’t get me wrong — the admonishment against claims that markets evolve into something where the old rules no longer apply was meant to remind us that human nature rules all. That’s the fundamental truth...that despair inevitably leads to euphoria and back again, and whatever the current fad may be, the age-old cycles of boom and bust will still maintain.

What I’m saying is something else about gold in particular. This new reality has been clearly explained with the release of what is simply the finest research report on gold.

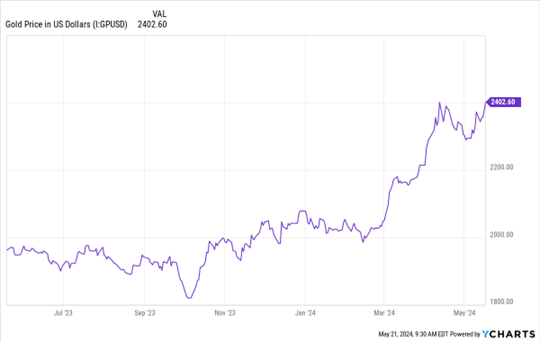

Data by YCharts

Every year about this time, I look forward to an email from my friend Ronald Stoeferle announcing that he, his colleague Mark Valek, and their team at Incrementum AG have completed their annual In Gold We Trust research report.

In this year’s version, they note that according to the old gold playbook, prices should have fallen significantly in an environment of sharply rising real interest rates. This and several other laws seem to have been suspended recently.

In the new gold playbook, Western financial investors are no longer the marginal buyers. Central banks and the steadily growing demand from emerging markets – especially China – have for the first time been able to more than compensate for weak demand from the West.

Sure enough, last Friday gold and silver exploded higher, bursting through key resistance levels. Gold jumped nearly $40 to easily break through the important $2,400 benchmark, while silver catapulted over 6.5% to not only clear $30, but top $31 as well!

Again, things are different these days. In this new normal for gold, the price is set in Asia, not New York, and bear attacks during Western trading are habitually beaten back.

Of course, we will eventually reach a point of euphoria and experience a sell-off in the metals. The thing to remember is that we’ve experienced a four-decade-plus trend of ever-easier money and that cycle — with all its attendant repercussions — is coming to a close. This is a long-term, multi-year trend...with many ups and downs along the way.

Make sure you’re ready by holding metals and miners.

Recommended Action: Buy gold.