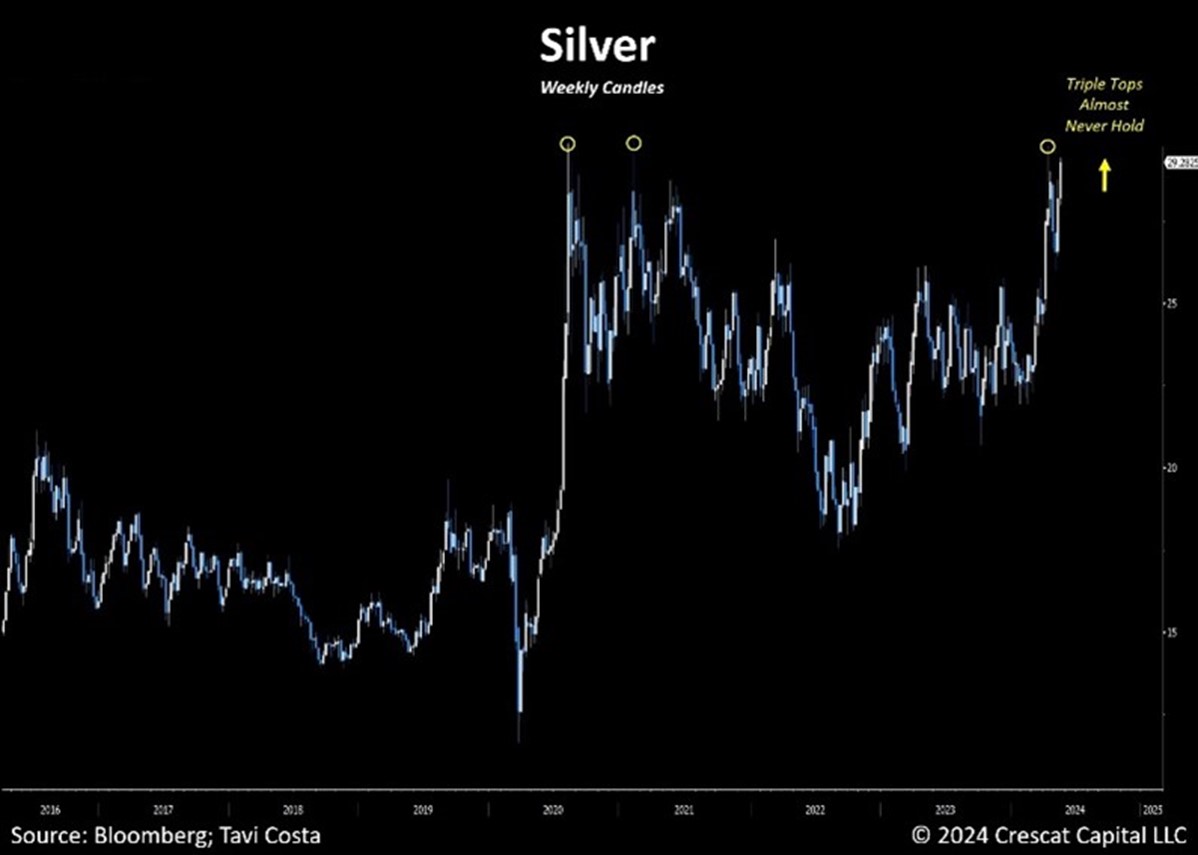

Over the past four years, silver has tested $30 three times. We’ve even seen silver reach new multi-decade highs in most major currencies. Then BOOM! It surged to $28 in April, pulled back to $26, then rocketed to $32 in the last three weeks. I like Wheaton Precious Metals Corp. (WPM) as a way to capitalize, suggests Peter Krauth, editor of Silver Stock Investor.

The $10 gain in silver from $22 to $32 is a massive 45%. A bull market is defined as a 20% gain, so we have clearly achieved that. I think there’s a lot more of this to come. And we are poised to benefit. But these gains have been so strong in such a short period, I’m inclined to turn a bit cautious now.

Don’t get me wrong. Silver at $30 is not the peak. If you’ve read my book, you know my ultimate target is $300, which I explain – with backup. That would be a 10x return just in silver from here. In fact, I fully expect that $30 will become a new floor in the silver price.

But some market digestion of recent gains would make sense right now and would help propel silver prices higher in the second half of this year.

As for WPM, it had a solid Q1, with $297M in revenue, $219M in operating cash flow, and $164M in net earnings. There’s $306M in cash and an undrawn $2 billion revolving credit facility.

Wheaton has streams and royalties on 18 operating mines and 27 development projects. Some 93% of their gold equivalent production of 160Koz in Q1, up 19% year-over-year, is from assets in the lower half of cost curves. WPM shares are up strongly since late February, but they remain attractive on pullbacks.

Recommended Action: Buy WPM on weakness.