The main reason to have registered accounts, such as RRSPs and TFSAs, has everything to do with withholding taxes, says John Heinzl, of the Globe and Mail.

Can you explain the tax consequences of investing in Brookfield Infrastructure Partners L.P.?

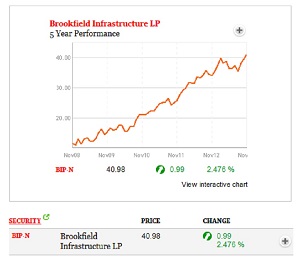

Brookfield Infrastructure (BIP) was one of six stocks I discussed in a recent column about companies that are poised to raise their dividends. Unlike the others, however, BIP isn't a corporation, but a limited partnership, and its distributions—they aren't technically dividends—are treated differently for tax purposes.

The main thing to be aware of here is that, in a limited partnership structure, income isn't taxed at the company level. Instead, it's taxed in the hands of the partners, or investors. This flow-through arrangement is similar to an income trust or real estate investment trust.

Now, if you hold BIP units in a registered retirement savings plan (RRSP) or registered retirement income fund (RRIF), the tax treatment is moot because you won't pay any taxes on the distributions anyway. (That's one reason I hold my BIP units in my RRSP).

However, if you hold the units in a non-registered account, it's a bit more complicated: You'll receive a tax slip (a T5013) that reports the various sources of income that make up the distribution, and you'll enter these amounts on your tax return.

The company also provides the tax breakdown on its Web site. For example, in 2012, the partnership distributed $1.50 (US) per unit to investors, or $1.4988 (Canadian). (The company—which owns a global portfolio of utility, energy, and transportation infrastructure assets—pays distributions in US currency, but it also provides the tax breakdown in Canadian dollars.)

In 2012, the taxable portion of the distribution consisted largely of foreign dividend and interest income (62.479 cents per unit), with smaller amounts of other investment income (20.071 cents) and capital gains (3.544 cents). There was also a small deduction for carrying charges (minus 6.703 cents).

You'll notice that these numbers don't add up to $1.4988. That's because the 2012 distribution also contained a hefty chunk of return of capital (70.489 cents). ROC isn't taxable immediately; rather, it is subtracted from the adjusted cost base (ACB) of the units, which gives rise to a larger capital gain, or smaller capital loss, when the units are ultimately sold. Many REITs and mutual funds also distribute ROC. ROC can be a bit of a headache for investors. If you hold BIP in a non-registered account, you (or your accountant), will need to track those ROC payments in order to keep your ACB up to date. Knowing the ACB is necessary to calculate your capital gain, or loss, when it comes time to sell.

I'm lazy and like to avoid paperwork if possible, which is another reason I hold BIP in my RRSP. The same goes for its sister company, Brookfield Renewable Energy Partners L.P. (BEP). That said, tracking the ACB isn't really a big deal—you can do it with a pencil or a simple spreadsheet.

However, here's another reason to consider holding BIP in an RRSP or RRIF: You'll avoid potential US withholding taxes. In non-registered accounts, “there are instances where [Canadian investors] would face withholding tax,” Tracey Wise, Brookfield Infrastructure's vice-president of investor relations, said in an e-mail.

US withholding tax could also apply to units in a tax-free savings account (TFSA) or registered education savings plan (RESP), she said. The good news is that, with non-registered accounts, the US tax withheld can usually be applied as a foreign tax credit, but that's not the case with TFSAs or RESPs. Nonetheless, Ms. Wise said withholding taxes are infrequent and “we do our best to make it as efficient as possible for all of our holders.”