It REALLY DID start out all quiet yesterday. Then equities suffered the “Powell Plunge”. They’re mixed in the early going today.

Treasuries are flattish as well, along with gold, silver, and the dollar.

On the news front...

No question what the big story is for markets: Interest rates! Fed Chairman Jay Powell testified in front of the Senate Banking Committee yesterday, and he made clear policymakers could A) Hike by larger amounts again (think 50 basis points instead of 25 bps) and B) Hike for a longer period of time.

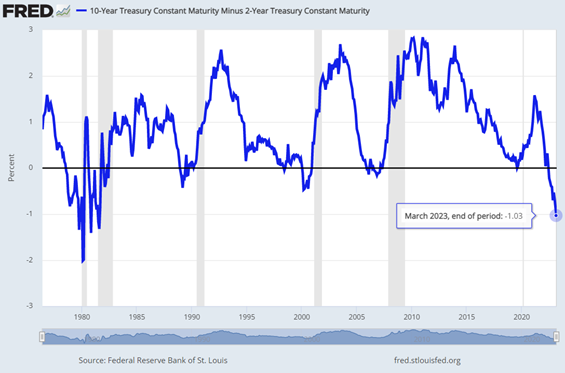

That caused stocks to plunge, the dollar to spike, precious metals to drop, and Treasury yields to rise. But it’s worth noting that in the bond market, SHORT-TERM yields rose much more than LONG-TERM ones. That caused the yield curve to invert even more.

The difference between the 2-year note yield and 10-year note yield sank to NEGATIVE-103 bps. We haven’t seen 2s/10s this inverted since 1981 – typically a sign bond investors expect the Fed to hike us into recession.

Speaking of interest rates, 30-year mortgage rates rose for the fourth straight week to 6.79%, according to the Mortgage Bankers Association. And that number is several days in arrears. With the recent rise in rates, you’d likely pay closer to 7% today.

We’re learning more about President Biden and his tax and spending proposals ahead of the official release of his budget tomorrow. His primary tax proposals will target unrealized gains on assets like stocks, boost taxes on stock buybacks, and raise taxes on high-income earners and corporations. He is also pledging to cut the deficit by $2 trillion, though deficits have persisted since 2000 – a period with both Democrats and Republicans in the White House.

Finally, ADP reported the economy added 242,000 jobs in February. That was a bit ahead of the 200,000 forecast. The Labor Department reports the official data on Friday.