Happy St. Patrick’s Day! In advance of the holiday, we got a bunch of green on our screens yesterday...but equities are slumping in the early going today.

Gold and silver are extending recent gains, as are Treasuries. In fact, gold is closing in on an 11-month high. The dollar is slightly lower.

On the news front...

In a move similar to the 1998 rescue of troubled hedge fund Long-Term Capital Management, a cabal of major U.S. banks and the U.S. government worked out a privately financed bailout of First Republic Bank (FRC). JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), and eight other banks agreed to deposit a total of $30 billion at First Republic to shore up its balance sheet and stop another bank run.

Treasury Secretary Janet Yellen and other regulators helped facilitate the deal, which temporarily stemmed the banking sector chaos. The SPDR S&P Regional Banking ETF (KRE) rose 3.5% yesterday in response.

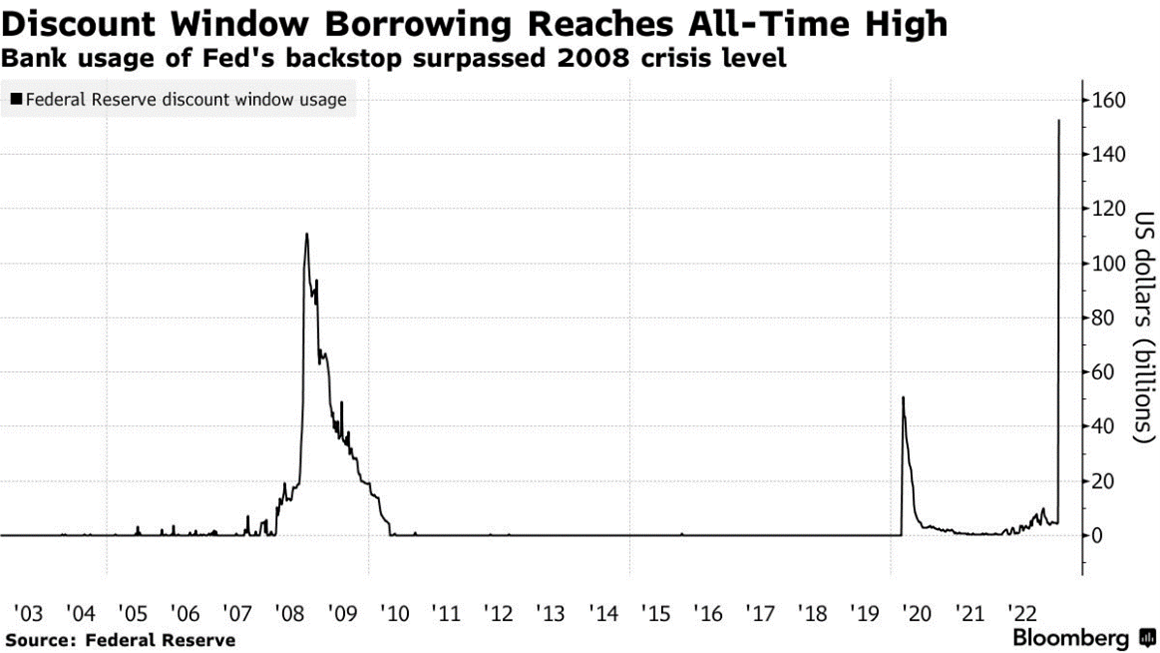

Meanwhile, the Federal Reserve reported that banks borrowed a whopping $164.8 billion from it in the week ended March 15. That was up from only $4.58 billion in the week prior, a surge that came amid widespread deposit flight. Borrowing at the Fed’s so-called “discount window” eclipsed the previous peak of $111 billion. It was set during the Great Financial Crisis in 2008.

On the geopolitical front, Chinese Premier Xi Jinping is planning to meet with Russian President Vladimir Putin in Russia next week. That’s the first time Xi has visited Russia since the Ukraine invasion, and it’s a sign the two nations want to solidify ties.

Finally, in corporate news, FedEx (FDX) beat adjusted earnings expectations in the most recent quarter. It also raised its full-year profit outlook. The shipping company cited job cuts and rate hikes for the stronger-than-expected results. FDX shares popped 11% in the pre-market on the news.