Stocks are modestly lower this morning amid worries over the U.S. debt ceiling. Treasuries, gold, silver, and crude oil are flattish, while the dollar is higher.

On the news front...

Discussions over the debt ceiling are heating up, with President Biden set to meet with Congressional Republican and Democratic leaders today at the White House. The talks likely won’t achieve any fundamental breakthroughs, even as both sides say they don’t want the U.S. to default on its debts in a few weeks.

Some perspective is in order here though. Ever since taking debt ceiling negotiations down to the wire set off a mini-market meltdown in 2011, both Republicans and Democrats have always caved on their demands at the last minute. This time will likely be no different, despite gloom-and-doom warnings emanating from Washington.

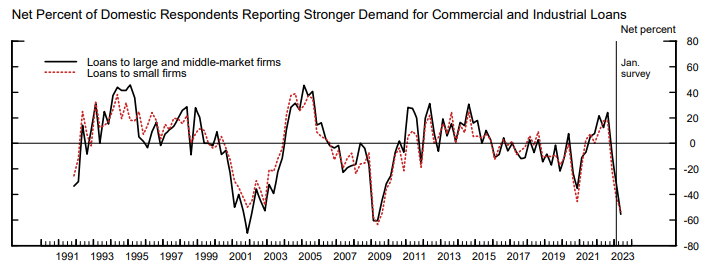

The Federal Reserve released its latest Senior Loan Officer Opinion Survey report – affectionately referred to by the acronym “SLOOS” – yesterday. The Fed’s quarterly survey of banks large and small found many were tightening lending standards at the same time they were seeing reduced borrowing demand from customers.

Conditions were the most concerning in the Commercial & Industrial (C&I) and Commercial Real Estate (CRE) businesses. As you can see in this Fed chart, demand for core C&I business loans has plummeted to levels we’ve seen only twice in the last three decades – the Dot-Com recession in 2000-2001 and the Great Financial Crisis in 2008-2009.

Oil prices have slumped in recent weeks despite promises of tighter supply from the OPEC+ countries. One reason? Russia appears to be pumping more. Seaborne shipments of Russian crude recently hit the highest in more than a year, according to Bloomberg. Oil recently traded below $70 a barrel, though it has bounced back in the last couple of days.