Stocks caught a case of the “Biden/McCarthy Blues” late yesterday. They’re trying to bounce back in the early going today, though. Gold, silver, and Treasuries are flat after a rough Tuesday, while Treasuries are flat. The dollar is higher.

On the news front...

Debt ceiling. Debt ceiling. Debt ceiling. Those are the top three things Wall Street appears to be focusing on, especially yesterday. Markets suffered a late-day slide after House Speaker Kevin McCarthy warned that Republicans and Democrats had "a lot of work to do in a short amount of time" to avoid a US debt default as soon as June. President Biden announced he’s cutting his Asian trip short to return to Washington on Sunday and resume talks.

Of course, earnings worries are percolating out there, too. Retailing giant Home Depot (HD) missed sales estimates in the fiscal first quarter by the biggest margin in 20 years. It also warned about profit margin pressure and said consumers were spending less on big-ticket items. Target (TGT) followed up with its own warning about softness in discretionary spending this morning, adding that second-quarter earnings would miss analyst estimates.

Shifting to Federal Reserve policy, JPMorgan Chase (JPM) analysts say the markets are “right” to be betting on a funds rate reversal soon. Interest rate futures traders are placing wagers the Fed will be forced to cut rates again as soon as September, despite a steady drumbeat of comments from Fed officials to the contrary.

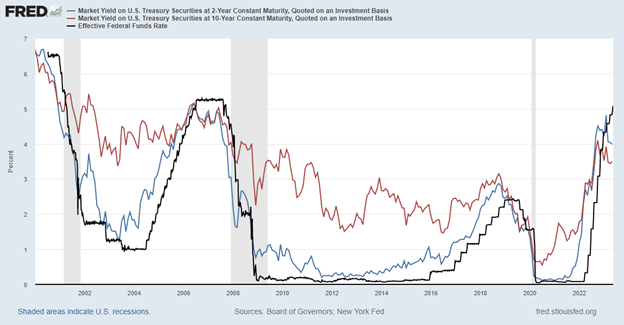

This chart is particularly telling. It shows the Fed’s benchmark funds rate (in black) compared to the yield on the 2-year Treasury (in blue) and the yield on 10-year Treasury (in red). Keep in mind that the Fed more or less directly controls the funds rate, while yields on Treasuries are set by investors and traders in the capital markets.

You can see that in the last three “Fed Pivots”, yields on Treasuries started falling BEFORE the Fed cut its benchmark rate. Or in other words, investors CORRECTLY diagnosed an impending slowdown in growth and inflation and bet the Fed would ultimately have to cave. Then that’s exactly what the Fed ultimately did. Food for thought!