The mixed market continues, with the Nasdaq continuing to wildly outperform the Dow. Outside of equities, which are down a bit in the early going, crude oil is under pressure. Gold and silver are flat, while Treasuries and the dollar are up.

On the news front...

We’re back to the dreaded “narrow market”...the one where a handful of mega-capitalization stocks keep the market propped up even as other names fall by the wayside. One indicator: The market-capitalization-weighted S&P 500 is outperforming the S&P 500 “Equal Weighted” index by the biggest margin since record-keeping began in 1990.

It’s not just a “Big Tech vs. Everything Else” phenomenon, either. While the biggest tech names are outperforming many “ordinary” stocks, bigger names in almost EVERY S&P sector are outperforming their smaller-capitalization brethren. That flight-to-bigness is typical investor behavior when worries about recession and/or credit quality rise.

Meanwhile, the debt ceiling deal struck by President Joe Biden and House Speaker Kevin McCarthy faces a key vote in the House of Representatives today. A rules committee narrowly passed the bill 7-6 last night, an indication it should get the green light today. But Wall Street will be watching closely for any surprises just in case.

Yesterday I wrote about China and concerns over economic growth slowing there in the long term. Turns out the short-term news isn’t so hot, either. Figures on consumer spending, production, and business investment are all coming in weak, and that has helped send the MSCI China Index into bear market territory. It has lost roughly a fifth of its value from its January peak.

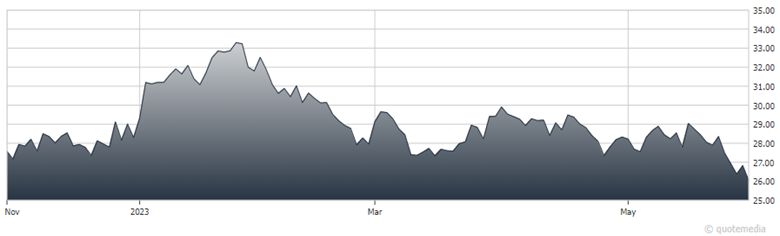

iShares China Large-Cap ETF (FXI)

Here in the US, the iShares China Large-Cap ETF (FXI) has lost just under 8% this year and more than 41% of its value in the last two years. The tech-levered KraneShares CSI China Internet ETF (KWEB) is in even worse shape. The $5.4 billion fund has dropped 17% year-to-date and 61% in the last two years.