Incredibly strong jobs data is jolting the stock market this morning by fueling new Fed fears. Treasuries are getting hammered along with gold and silver, while the dollar is trading around the flatline.

On the news front…

This morning’s ADP employment report blew the doors off! The payroll processing company said the economy added 497,000 jobs in June, more than double the average economist forecast of 228,000. It was also up sharply from 278,000 in May.

While the official government numbers won’t hit until Friday morning, this all but extinguishes any doubt the Federal Reserve will hike interest rates another 25 basis points when it meets on July 25-26. The June meeting minutes released yesterday showed several Fed members would’ve been okay with hiking at that gathering, even as they ultimately decided to hold off for a bit longer.

Meta Platforms (META) fired a major salvo in the social media wars, launching its “Threads” app to compete directly with Twitter. The app is intended to work in conjunction with Meta’s Instagram photo-sharing network, allowing Instagram users to do many of the same things people can do on Twitter.

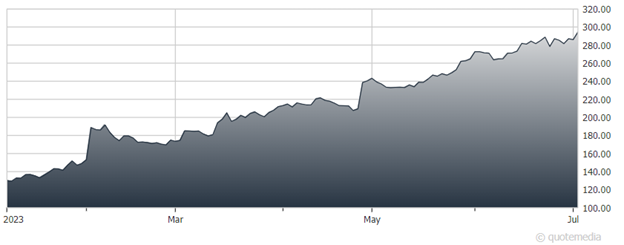

META CEO Mark Zuckerberg is trying to capitalize on the unhappiness many Twitter users have expressed with changes implemented by Elon Musk since he bought the company. And it comes as META shares have been on fire, up 135% year-to-date.

Meta Platforms (META)

Finally, if you’re looking for a group of businesses to “feel sorry” for, pity the banking industry. After years of paying 0.01% on customer savings accounts and peanuts on their CDs, they’re having to actually pay interest to their depositors. That’s because they’re having to compete for customer funds with alternative, safe investment vehicles that pay much higher yields, such as US Treasuries and Treasury money funds.