Yes, the Dow rallied again yesterday. Yes, it outperformed the other major indices. Yes, that was it’s 11th straight day of gains. And yes, that’s the longest winning stretch since February 2017. How about that?

In the early going today, equities are relatively flat along with crude oil and the dollar. Gold and silver are mixed, while Treasuries are slightly lower.

On the news front…

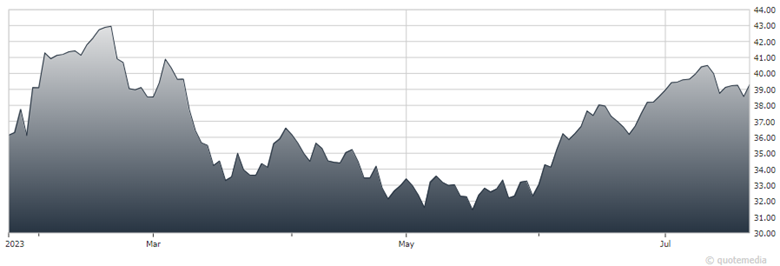

General Motors (GM) trounced analyst estimates in the second quarter, reporting revenue of $44.7 billion and earnings per share of $1.91. Analysts were looking for only $42.8 billion and $1.65, respectively. The automaker also boosted its profit forecast for a second time, citing strong consumer demand. Shares were up about 17% through yesterday.

General Motors (GM)

Okay, so it’s not exactly as exciting as the 1981 movie classic “Clash of the Titans.” But depending on who wins the “Clash of the Doves and Hawks” at the Federal Reserve, markets could be either cheered or spooked later in 2023.

Another 25-point rate hike is locked in for tomorrow. But it’s the future that is in flux. The Waller/Mester/Bowman wing of the Fed would like to keep the rate-hiking pressure on to slay inflation, while the Daly/Bostic/Goolsbee crew seems more inclined to give the past hikes a chance to work.

Finally, one noted Wall Street bear is throwing in the towel in the face of this year’s relentless market rally. Morgan Stanley’s Mike Wilson published a note this week saying “We were wrong” about how 2023 would shake out.

Warnings about everything from tech stock valuations to banking turmoil have fallen on deaf ears, leaving Wilson’s S&P 500 year-end forecast of 3,900 far below its current level (almost 4,600). As the famous physicist Niels Bohr reportedly once said, “Prediction is very difficult, especially if it’s about the future!”