What happens when you get “Goldilocks” economic data, strong earnings, and a Fed that might be moving to the sidelines? The longest Dow winning streak since 1987 (13 “up” days in a row through yesterday) and a strong open to boot!

In other markets, crude oil is higher and flirting with $80 a barrel again. Gold, silver, and Treasuries are lower, while the dollar is up.

On the news front…

We got a ton of economic data this morning and it certainly made a statement. A statement that the economy is doing just FINE, thank you very much!

To sum up, durable goods orders in June were stronger than expected. GDP growth in Q2 was stronger than expected. Initial jobless claims were lower than expected. And Personal Consumption Expenditures (PCE) inflation was lower than expected. Talk about “Be Bold” data!

Meanwhile, the least-surprising, most-telegraphed Federal Reserve hike in ages occurred yesterday. But as you can see from the market recap section above, it was met by a collective shrug on Wall Street. That’s because after raising interest rates by 25 basis points to a range of 5.25% to 5.5%, Fed Chairman Jay Powell said he was encouraged by progress on the inflation and jobs front.

Powell also implied it’s a toss up whether the Fed will hike further. That means the Fed could easily do nothing at its next meeting on September 20, as well as the final meetings in 2023 that are scheduled for Oct. 31-Nov. 1 and Dec. 12-13. Markets are only putting a 20% probability on another September hike as of this morning, per the CME’s FedWatch Tool.

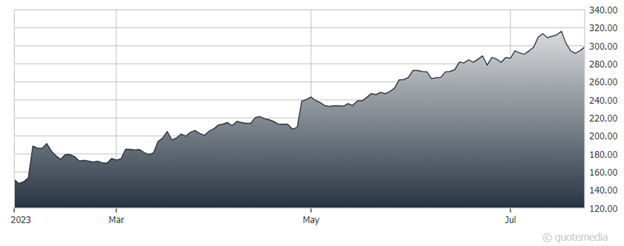

Shares of Meta Platforms (META) jumped in early trading after the search giant beat both sales and profit expectations in the second quarter. The firm projected revenue of $32 billion to $34.5 billion for the third quarter, too, well above what the market expected. Shares of the Facebook, Instagram, and now Threads app producer have been on fire in 2023, up 139% through yesterday’s close.

Meta Platforms (META)

McDonald’s (MCD) is loving it...if by “it”, you mean the gains in traffic and customer spending it’s experiencing. The fast-food giant said same-store sales surged almost 12% in the second quarter, topping the 9.4% increase analysts had penciled in. MCD is in the midst of cutting costs and restructuring to boost profit, something that crimped earnings by 2 cents per share in the quarter.