After extending its winning streak yesterday (more in a minute), the S&P 500 looks set to give back some gains in the early going. The same goes for crude oil, gold, silver, and Treasuries. The dollar is popping, though.

On the news front...

Yesterday’s advance came as the S&P 500 closed out a fifth straight month of gains. That is the benchmark index’s longest streak of “up” months since 2021. While the S&P gained 3.1% in July, it’s worth noting the Dow Jones Industrial Average actually did a little bit better at +3.3%.

What does that help illustrate? That the advance is broadening out now, with formerly beaten-down sectors making a nice comeback. The KBW Nasdaq Regional Banking Index jumped more than 18% in July, gaining back some of the ground it lost earlier in 2023 due to bank deposit flight fears.

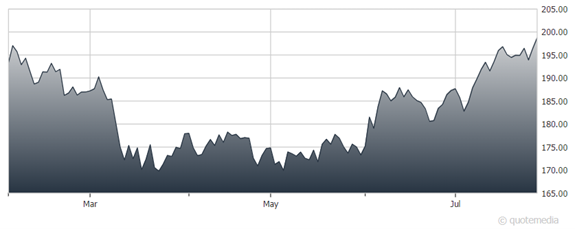

Even the iShares Russell 2000 ETF (IWM) tacked on almost 8% in the last 30 days. That should help calm fears that smaller capitalization stocks aren’t “Keeping up with the Joneses (Big Tech).”

iShares Russell 2000 ETF (IWM)

Ukraine appears to be stepping up strikes inside Russian territory, targeting the same building today in central Moscow that it had struck 48 hours earlier. Russia said it shot down two other drones that approached the capital city. The building reportedly plays host to Russia’s digital development, economy, and industrial development offices.

Finally, Uber Technologies (UBER) reported a surprise profit of $394 million in the second quarter. It also generated its first GAAP operating profit of $326 million.

No, it shouldn’t be surprising to hear a company actually made money. But Uber and many of its tech cohorts willingly lost billions and billions of dollars expanding willy-nilly when money was cheap and easy. They only shifted strategies and focused on making money in the last couple of years – largely because markets forced them to.