Stocks just can’t escape the “China Crunch” going on in that country. Equities suffered another late day loss yesterday, and they’re taking on water this morning, too.

Treasury bonds are finally firming a bit though, along with gold and silver. Crude oil is higher, while the dollar is flat.

On the news front...

It’s all about China. Yet again. The Wall Street Journal went with the “subtle worry” approach (ha!), blaring the headline “Investors Fear China’s ‘Lehman Moment’ is Looming.” That, of course, is a reference to how falling US property values and mortgage-related losses caused widespread panic on Wall Street and a credit crunch on Main Street circa 2008-2009.

In China, the issues boil down to this: Developers borrowed trillions of yuan to finance the construction of apartment complexes and other properties all over the country. Now, demand is slumping, and sales and housing prices are falling. Loan payments are coming due, but borrowers can’t pay back what they owe because less money is coming in the door.

Worse, many developers raised money from a “shadow market” of trust companies versus through more highly regulated banks. Companies and consumers invested money with those trust companies based on the promise they’d earn high yields and high returns. But now some of the trust companies are suspending payments to investors due to the broader trouble.

To top it all off, the largest developer in China – China Evergrande Group – just filed for bankruptcy Thursday in New York. The firm has more than $300 billion in liabilities globally, and is also reportedly trying to restructure in other jurisdictions where it has exposure like Hong Kong.

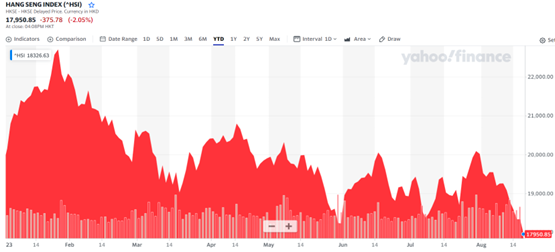

That’s prompting a selloff in the Chinese stock market, a selloff in the Chinese currency, and even some civil unrest. Quite the mess! The Hong Kong Hang Seng Index (chart above) recently tumbled into bear market territory, while the iShares China Large-Cap ETF (FXI) traded here in the US is now down roughly 8% year-to-date. That trails the SPDR S&P 500 ETF Trust (SPY) by a whopping 23 percentage points!

In other news...at least it’s Friday and interest rates are falling (a bit). That could allow global stocks to catch their breath after racking up their worst weekly performance since March. The MSCI World Index is on track to lose a bit less than 3%.