Stocks caught a break on Friday, and they’re adding to gains this morning, too. Meanwhile, crude oil, gold, and silver are flattish along with the dollar. Treasuries are up a bit.

On the news front...

If at first you don’t succeed, try, try again? That appears to be the plan in China, seeing as financial policymakers tried to prop up the nation’s stock market again.

Authorities cut the trading tax to 0.05% and also said they would stem the supply of Initial Public Offerings (IPOs) hitting the market. While those measures initially caused stocks to surge more than 5%, those gains faded to about 1% by the close.

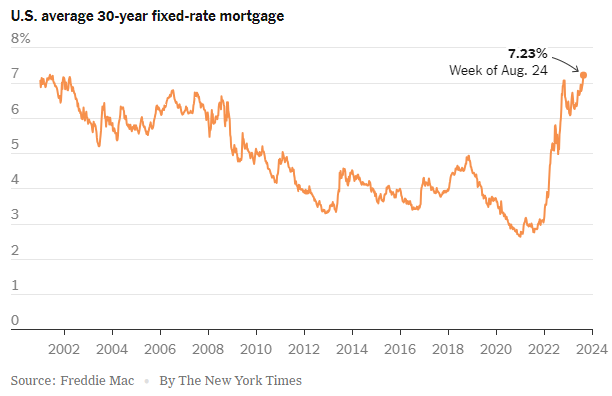

The Federal Reserve’s Jackson Hole Symposium may be over. But interest rates are still on the mind of investors...and potential home buyers. Mortgage rates are hovering in the 7.2% to 7.3% range, which is a 22-year high.

Chairman Jay Powell made clear that while the Fed may take a break from hiking rates for a bit, it will NOT be cutting them any time soon. That means home shoppers likely won’t see any relief from charts like this for a while.

The automakers have enjoyed a great run with strong demand and strong pricing. Now, the United Auto Workers (UAW) union wants a bigger piece of the action. Shawn Fain is UAW president and he wants General Motors (GM), Ford (F), and Stellantis NV (STLA) to grant double-digit wake hikes, restore cost-of-living increases, and boost pension payouts. Negotiations on a new contract have to be wrapped up by September 14.