It’s a bit of a laborious start to the post-Labor-Day trading season, with stocks and Treasuries a bit weaker here. Gold and silver are lower, too, while the dollar is higher. Crude oil popped after Saudi Arabia said it would extend unilateral production cuts through the end of the year.

On the news front...

The Labor Day holiday is over, which means vacation season is over on Wall Street, too. That’s why SoftBank Group is gearing up for its mega-Initial Public Offering (IPO) of Arm Holdings Ltd. The Japanese technology investing firm filed updated paperwork saying it wants to sell 95.5 million American Depository Receipts (ADRs) of the company for $47 to $51 each under the ticker symbol “ARM.”

That would raise about $4.9 billion, making this the biggest IPO of 2023 if all goes as planned. If the semiconductor design firm’s IPO brings healthy demand, it could reignite a tech IPO market that has been all but frozen for several quarters now.

While China still faces plenty of credit problems, many tied to a real estate bust in that country, the developer Country Garden Holdings Co. narrowly avoided defaulting on its dollar-based bonds. The firm owed $22.5 million in interest on a pair of bonds, and managed to get the money to investors before a grace period ended tomorrow. The firm has a hefty 1.36 trillion Chinese yuan ($187 billion) in liabilities.

Remember how I used to urge you to “Be Boring” as an investor, circa H2 2021 – Year-End 2022? There were a lot of reasons, but one of them was that “boring” sectors and stocks were dramatically outperforming. I shifted to a “Be Bold” stance at the beginning of 2023, in part because those same sectors and stocks started dramatically UNDERperforming.

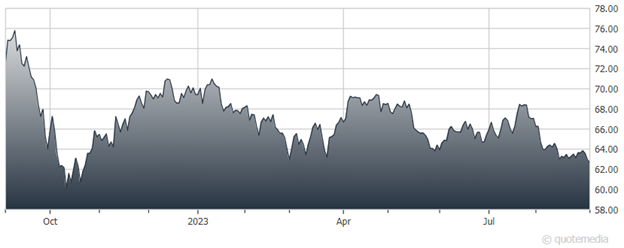

Utilities Select Sector SPDR Fund (XLU)

This Wall Street Journal story notes that utilities have been the worst-performing S&P 500 group so far this year, losing 12% as you can see in this chart of the Utilities Select Sector SPDR Fund (XLU). That’s because higher interest rates have given yield-seeking investors other alternatives to the juicy dividends utility stocks pay out. Plus, better economic news has encouraged buyers to flock to more offensive, growthier segments rather than defensive ones.