Stocks took a late-day dive yesterday, and they’re looking a bit weak this morning too. But crude oil is the big story, up another 1%-plus yesterday to a 10-month high. Gold, silver, and the dollar are flattish, while Treasuries are a bit higher.

On the news front...

Prices for crude oil and petroleum-derived fuels like diesel are on the march higher amid tighter supply and hope for stronger demand. Saudi Arabia’s announcement yesterday that it would extend a 1-million barrel-per-day production cut from October through the end of the year fueled a 1.3% gain in crude.

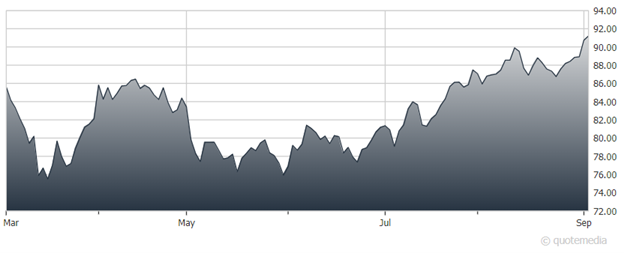

But it’s diesel that has really been on fire, with benchmark prices in the US and Europe up 40% since May. Energy investors are taking notice, with the Energy Select Sector SPDR Fund (XLE) up 6% in the last month and 15% in the last 90 days, as you can see here.

Energy Select Sector SPDR Fund (XLE)

There aren’t many signs of life on the home-purchase front, with applications for loans to buy homes continuing to fall. A key Mortgage Bankers Association index slumped another 2.1% this week to 141.9, a fresh 28-year low. Unless and until existing home supply rises further, prices adjust to make housing more affordable, and mortgage rates fall notably, the market will likely remain moribund.

If you thought soaring rents were bad enough, now there are soaring FEES being piled on top! Landlords both large and small are following the example of the airline industry and charging fees for all kinds of services on top of the monthly rent. Valet trash fees, pest control fees, mailbox usage fees, air-conditioning filter fees. They’re all in the mix, according to the Wall Street Journal.