Stocks are trying to tack on some gains this morning, though a fresh batch of economic data isn’t helping much. Gold and silver are lower, while crude oil, the dollar, and Treasuries are higher.

On the news front...

SoftBank Group (SFTBY) got its deal for Arm Holdings (ARM) done at the high end of its hoped-for price range. The tech investment firm sold shares at $51 each, at the top of its pre-Initial Public Offering estimated range of $47-$51 (though down from a rumored $52 aspirational target). The semiconductor design firm’s shares will start trading on the Nasdaq today, giving every other investor who didn’t secure shares in the IPO a chance to buy in.

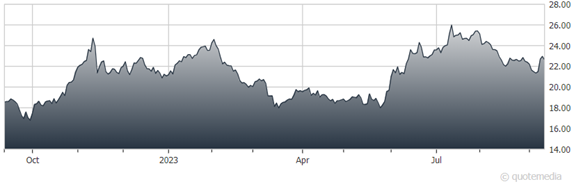

SoftBank Group ADR (SFTBY)

Other private tech companies are waiting in the wings for their own IPOs. The grocery delivery firm Instacart wants to sell 22 million shares in a price range of $26 to $28 each, for instance.

That would give the firm a valuation of as much as $9.3 billion – not too shabby, but WAY lower than the $39 billion it was valued at in a transaction from 2021. That just goes to show how much things have cooled since those Dot-Com Bubble-Like days! If the deal is successful, it’ll trade under the ticker “CART” before too long.

This morning’s Producer Price Index (PPI, which measures wholesale-level inflation) came in hotter than expected. Retail sales came in hotter than expected. And jobless claims came in lower than expected. STILL shouldn’t make the Federal Reserve hike next week. But not what the “Inflation is dead” crowd was hoping for.

Meanwhile, the Big Three automakers could face a United Auto Workers strike tomorrow if they can’t reach a last-minute contract deal with the union tonight. UAW President Shawn Fain has promised to launch “limited and targeted” walkouts tomorrow if the carmakers don’t step up with double-digit wage increases, cost-of-living adjustments to combat inflation, and improved retirement benefits.

Keep an eye on shares of General Motors (GM), Ford Motor (F), and Stellantis NV (STLA), the company behind Chrysler, Fiat, Dodge, and Jeep vehicles, among others. STLA is the best-performing one of them in 2023, with a 41% YTD return, while GM is bringing up the rear at +0.3%.