Strong headline jobs data had markets on the ropes in the early going, with stocks and Treasuries falling amid expectations they’ll keep Federal Reserve interest rate hikes in play. Gold, silver, and crude oil were a bit lower, while the dollar was higher.

Keep in mind that employment report days can be EXTREMELY volatile though. Early moves often reverse (and sometimes extend dramatically) into the close.

On the news front...

“Jobs Friday” is the biggest day for economic data all month…and there were definitely a few surprises in the data we got this morning. In September, the US economy created 336,000 jobs – roughly DOUBLE the consensus forecast of 170,000. But the unemployment rate topped estimates at 3.8% (forecast was 3.7%). Average hourly earnings rose a less-than-expected 0.2% (forecast was +0.3%). The news keeps the Fed “in play” for another potential rate hike heading before year end...but doesn’t GUARANTEE we’ll get one.

Looks like a “Big Oil” company is doing a Big Deal. Specifically, Exxon Mobil (XOM) is planning to buy Pioneer Natural Resources (PXD) for around $60 billion, according to the Wall Street Journal. XOM has a market cap of around $436 billion, while PXD sports a capitalization of around $50 billion.

That would make this the biggest deal for XOM since it bought Mobil in 1999. It would also easily top the $38 billion buyout of Anadarko Petroleum by Occidental Petroleum (OXY) in 2019. Oil companies built up sizable war chests of cash in the last few years, some of which they’re returning to shareholders as dividends and buybacks...and some of which they’re using to go “shopping” in the oil and gas sector.

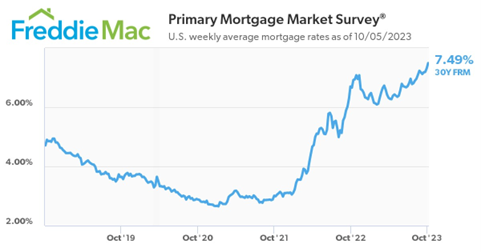

There’s no rest for the weary in housing these days. Thirty-year mortgage rates rose again to 7.49% this week, according to Freddie Mac’s benchmark survey. That compares to 7.31% a week earlier and 6.66% in the same week of 2022. Not surprisingly, applications for loans to buy homes dropped another 6% to a three-decade low, according to the Mortgage Bankers Association.