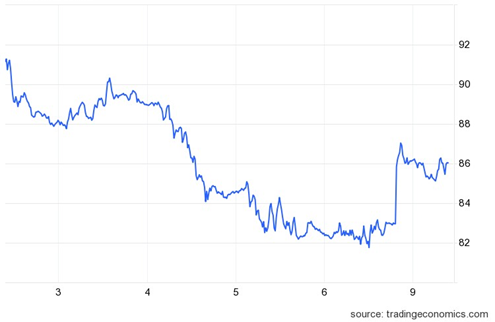

What is happening in the Middle East is a clear human tragedy. But it’s worth noting there have been market impacts as well. Crude oil prices jumped more than 5% overnight before easing back a bit, while gold rose more than $16. Stocks are sharply lower, while the US dollar is higher. The US bond market is closed for Columbus Day.

On the news front...

War has broken out in the Middle East. Hundreds of Hamas militants stormed across the Gaza Strip border over the weekend by air, land, and sea, wantonly killing and taking hostages throughout southern Israel. Thousands of rockets were also fired at towns and cities throughout Israel. More than 700 Israelis have reportedly been killed, while almost 500 Palestinians have died as a result of fierce counterattacks. Up to 150 hostages are being held in Gaza.

Israel was caught by surprise, leading to widespread questions on how its vaunted intelligence network failed. The US is sending the USS Gerald R. Ford aircraft carrier and associated ships to the eastern Mediterranean as a show of force and support. More than 300,000 reservists have been called up in Israel ahead of what may be a ground invasion into Gaza.

Worries about a broader conflict are clearly on the mind of government officials and investors. One reason: Members of Hamas and the other major militant group Hezbollah claim Iranian security officials helped plan and support the attacks.

WTI Crude Oil Futures

That raises the risk of Israeli strikes on Iran or other countries getting drawn into the conflict, particularly if Israel attacks Hezbollah in the north in addition to Hamas in the south. It also has energy markets on edge because of concern about supply disruptions from key Middle Eastern crude oil and natural gas producers.