Stocks continue to look relatively healthy despite the Middle East war and mediocre inflation news. Meanwhile, Treasuries are up, gold and silver are modestly higher, crude oil is a bit lower, and the dollar is flattish.

On the news front...

Israel continues to gear up for a likely ground invasion of the Gaza Strip, massing troops, tanks, and other equipment on the border and continuing to pummel targets from the air. President Biden condemned Hamas’ atrocities yesterday, and US Secretary of State Anthony Blinken will arrive in Israel soon as a sign of solidarity. The death toll has reportedly climbed to 1,200 Israelis and 1,055 Palestinians.

As for the big financial markets story of the day – inflation – the Producer Price Index rose 0.5% on the headline and 0.3% on the core (which excludes food and energy). Economists had expected the wholesale inflation measures to rise 0.4% and 0.2% respectively.

Despite the slightly hotter-than-expected numbers, markets didn’t flinch. The true test of their resolve will likely come tomorrow when the more-important Consumer Price Index data is released.

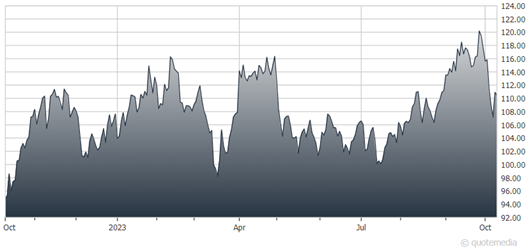

Exxon Mobil (XOM)

Well, it’s official. Exxon Mobil (XOM) confirmed it will buy Pioneer Natural Resources (PXD) for just under $60 billion, or $253 per share. That’s about 18% more than PXD was trading at before news of a likely deal broke several days ago.

XOM will boost its output from the Permian Basin to two million barrels per day over the next few years, making it the dominant player in the low-cost, shale oil production region. It’s the largest takeover Exxon has launched since it bought Mobil in 1999.