Stocks climbed their way back from a midday selloff yesterday, and in the wake of this morning’s inflation data, they’re trying to give it another go today. Gold, silver, and Treasuries are mostly flat, while the dollar and crude oil are modestly higher.

On the news front...

Wall Street’s attention shifted from geopolitics to economics this morning. That’s because the government released the all-important Consumer Price Index (CPI) for September. The headline CPI rose 0.4% on the month, while the core CPI that excludes food and energy rose 0.3%. The headline number was a bit above the +0.3% forecast, but the core number matched it.

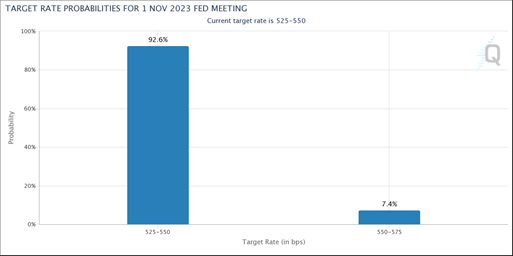

All week long, Federal Reserve members have dropped hints they’re inclined to stand pat with interest rates at the meeting that concludes Nov. 1. That has caused rate futures traders to pare back bets for another 25-basis point hike. In fact, markets are now pricing in a 90%-plus chance the Fed does nothing at that meeting, as you can see here.

Many investors are also starting to think the Fed is done for 2023 overall (The last policy meeting wraps on Dec. 13). What does that mean for markets? Well, my post-CPI take on Twitter/X (You can follow me at Mike Larson (@RealMikeLarson) / X (twitter.com) and the MoneyShow account at @MoneyShow) was as follows this morning:

“Honestly? My snap reaction here is don't overthink. Just buy. Bonds. Stocks. Gold. You name it. Sure, CPI was a bit hot. But doesn't look like enough to change the #Fed calculus for the Oct. 31/Nov. 1 meeting - and it increasingly looks like the Fed is done for 2023.”

Meanwhile, Israel continues to gear up for a likely ground invasion of the Gaza Strip, launching more airstrikes and massing troops and armor near the border. US Secretary of State Anthony Blinken gave a speech in Tel Aviv condemning Hamas today. He also announced that the death toll for Americans from the attacks climbed to 25.