We are seeing an extremely powerful move higher in “safe havens” like Treasuries and gold, with the latter jumping almost $50-an-ounce at one point. Crude oil is rising more than 4%. The catalyst? Expectations that a ground war in Gaza could start at any time, plus the potential for Iran to get involved in the conflict.

Equities are holding up, however, due to strong earnings reports from early-bird banks and cooler-than-expected import price data.

On the news front...

All signs point toward an impending ground war in the Gaza Strip, with Israel warning civilians in the northern part of the Palestinian territory to evacuate to the south. The Israeli military gave a 24-hour deadline, which could suggest troops and tanks will pour across the border soon.

Meanwhile, Iran warned that what it calls the “humanitarian siege on Gaza” could cause a “new front” to open up against Israel. That’s a thinly veiled threat of a possible broadening out of the conflict, such as a Hezbollah attack on Israel’s northern border. The combined weight of the developments has caused furious buying in safe havens like government bonds and gold, as well as a jump in crude oil prices.

On Wall Street, Q3 earnings season kicked off today with reports from a handful of big banks. JPMorgan Chase & Co. (JPM) and Wells Fargo & Co. (WFC) both reported blowout net interest income (NII), the traditional “core” earnings driver for banks. On the other hand, bank officials cautioned that a slowing economy could reduce loan demand and cause charge-offs to rise.

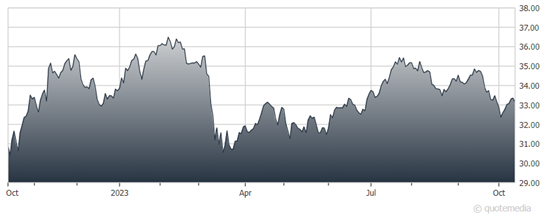

The Financial Select Sector SPDR Fund (XLF) holds shares of both of those banks. It has been trying to battle back from early-year losses caused by deposit flight and a rash of failures. But it remains slightly in the red year-to-date, and up just 7% over the past 12 months. The SPDR S&P 500 ETF Trust (SPY) has risen roughly 15% and 20% in those same timeframes.

Financial Select Sector SPDR Fund (XLF)