Stocks got pummeled yesterday right alongside Treasuries, though we’re seeing both markets attempt to stabilize in the early going today. The dollar is lower, while gold, silver, and crude oil are trading not far from the flatline.

On the news front...

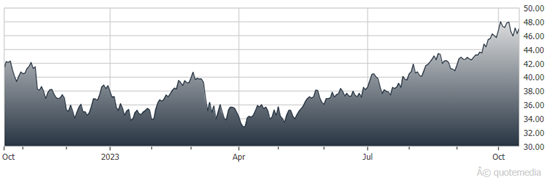

It was a “Rate Rout” in the market yesterday, with surging interest rates AGAIN putting pressure on stocks. The yield on the benchmark 10-year Treasury Note is now just a smidge shy of 5%, another big, round number of the kind that gets investors’ attention.

Worse, investors using a traditional 60/40 approach to investing and risk management aren’t getting what they bargained for. The standard 60% stocks/40% bonds portfolio lost 17% in 2022, the worst year since at least the 1930s.

Plus, we’re seeing a much higher correlation between stock and bond prices over the last few years than we have historically, according to this Wall Street Journal story. Translation? Instead of your bonds going up in price when your stocks go down, both are going down in tandem more frequently.

CBOE 10-Year Treasury Note Index (TNX)

Then again, Morgan Stanely Investment Management thinks 5% is an ideal level for NEW bond buyers to step in. Vishal Khanduja said the bond market has “done the job” for the Federal Reserve, so no more rate hikes are likely, and that Treasury yields are in the “overshoot category” now given how far and fast they’ve moved.

Meanwhile, the quarterly earnings parade keeps marching on. Carmaker Tesla (TSLA) reported after the bell yesterday, missing analyst earnings and revenue estimates and offering a tempered outlook for the future. Shares slumped as a result. On the other hand, streaming video colossus Netflix (NFLX) beat forecasts for profit and net subscriber growth AND announced price hikes for its service. The stock popped on the news.