Stocks finished last week on a weak note, and they’re starting this week off the same way. Treasuries were also recently selling off, while gold, silver, the dollar, and crude oil were mostly flat.

On the news front...

Israel is continuing to bomb targets in the Gaza Strip ahead of a potential ground invasion. At the same time, the first humanitarian aid deliveries in Gaza have begun – and Hamas also released two American hostages on Friday out of an expected 220 or so being held. US officials are trying to get Israel to hold off on an invasion to give hostage negotiations more time to play out and more food, water, and medical supplies to get shipped into the territory.

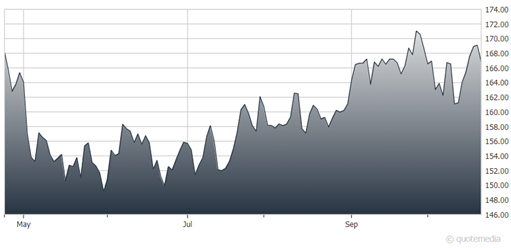

Big Oil is getting bigger these days, with Chevron (CVX) the latest company to announce a mega-deal. The company has agreed to buy Hess (HES) for about $53 billion, or $171 per share.

Chevron (CVX)

The all-stock acquisition will give CVX exposure to Guyana, an emerging producer in South America, as well as more assets in the Gulf of Mexico and the Bakken shale here in the US. It follows news of the recent tie-up between Exxon Mobil (XOM) and Pioneer Natural Resources (PXD), a transaction valued at $58 billion.

As for interest rates, the yield on the 10-year Treasury breached the 5% mark earlier today amid ongoing selling in US and foreign bonds. Investors and economists are increasingly citing things like concern over the ballooning budget deficit for the rise, rather than typical drivers like changing expectations on Federal Reserve policy.

Regardless of the cause of higher yields, the result is that benchmark bond market investments like the iShares Core US Aggregate Bond ETF (AGG) and iShares 20+ Year Treasury Bond ETF (TLT) continue to lose money. AGG is down about 3% YTD, while TLT is off 14%.