Equities sank yesterday, dragged down by Big Tech. Stocks are a bit weaker again today, while Treasuries are a bit stronger. Gold, silver, and crude oil are all lower. The dollar is flattish.

On the news front...

Sooooo earnings season isn’t quite going how the bulls planned, at least in the tech sector. The so-called “Magnificent Seven” technology names have led the markets lower, shedding a whopping $200 billion in market capitalization in the past several days. That includes $180 billion at Alphabet (GOOGL), $72 billion at Tesla (TSLA), and an estimated $30 billion at Meta Platforms (META).

A $75 billion gain at Microsoft (MSFT) did help partially offset those losses. We also haven’t yet gotten numbers from Amazon (AMZN), which reports after the close today, or Apple (AAPL) and Nvidia (NVDA), which both report next month. But it’s not exactly what people we’re hoping for this third quarter.

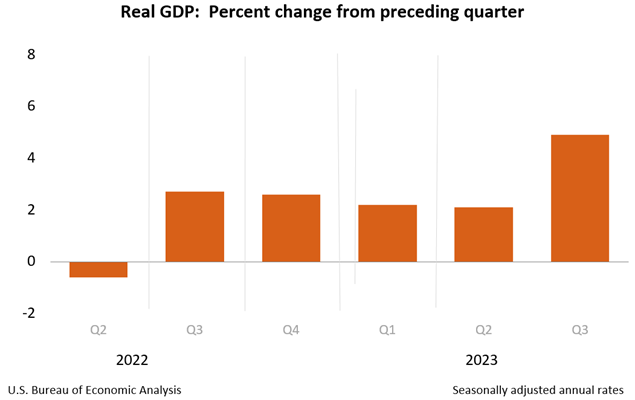

Meanwhile, we just got a whole host of economic data today. To summarize, durable goods orders for September trounced estimates...Q3 GDP came in hotter than expected at +4.9%...but jobless claims were slightly higher than forecast and an inflation number in the GDP report was a bit tamer than it was predicted to be.

The net result? Not much change in markets from their pre-data levels. The Federal Reserve is still expected to sit tight at the meeting that ends Nov. 1, just as the European Central Bank pressed “pause” on its hiking campaign this morning.

Could an end be in sight for the United Auto Workers strike? That’s what some are hoping after the UAW reached a tentative deal with Ford Motor (F). The union secured a 25% hike in wages over the next four-and-a-half years, along with cost-of-living adjustments. Roughly 20,000 employees will return from striking and associated layoffs, though membership still hast to ratify the agreement.