Stocks are continuing to rip higher after a strong start to the week and a strong day yesterday. Gold and silver are going along for the ride, as is crude oil. Meanwhile, long-term Treasuries are surging while the dollar is tanking.

What’s driving these trends? Federal Reserve Chairman Jay Powell spread a little pre-holiday joy on Wall Street yesterday.

Specifically, the Fed head and his cohorts decided not to hike interest rates from their current 5.25% - 5.5% range at their latest meeting. Powell also hinted that hikes are over for now (and possibly the entire cycle). One of his quotes at a post-meeting press conference: “The question we’re asking is: Should we hike more?”

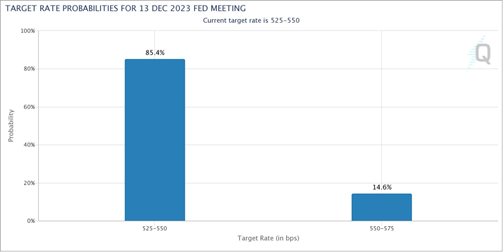

The chart below is from the CME FedWatch Tool. You can see markets are now only pricing in a 15% chance of an interest rate hike at the Fed’s next meeting, which concludes Dec. 13. Coupled with slightly encouraging news on the government’s borrowing plans earlier in the day, the news prompted further rallies in stocks, gold, and long-term Treasuries.

Incidentally, if you were at the MoneyShow/TradersEXPO Orlando on Sunday, you heard my reasons why I believe those moves could continue for the rest of 2023 (and potentially beyond). I also shared a briefer version of my thesis on X. But it boils down to there being WAY too much negative sentiment out there for a market where conditions are mixed, rather than overly bearish or bullish.

Fresh off a big win in contract negotiations with Ford Motor (F), General Motors (GM), and Stellantis (STLA), will United Auto Workers (UAW) head Shawn Fain target non-union car and truck makers next? That’s the scenario this Wall Street Journal story discusses. Companies like Tesla (TSLA) and Toyota Motor (TM) would be at the center of any renewed drive to unionize.

Lastly, we got another batch of “soft landing” data this morning. Initial jobless claims rose, but didn’t soar. Q3 productivity came in at a higher-than-expected 4.7%. Plus, Q3 labor costs fell 0.8%, compared with forecasts for a rise of 0.7%. These kinds of numbers are what Wall Street wants to see because they’ll keep the Fed on the sidelines.