This week has been all about the “soft landing” train steamrolling the bearishly inclined. In the early going today, stocks are rising AGAIN along with long-term Treasuries. Gold and silver are also jumping, while the dollar is slipping.

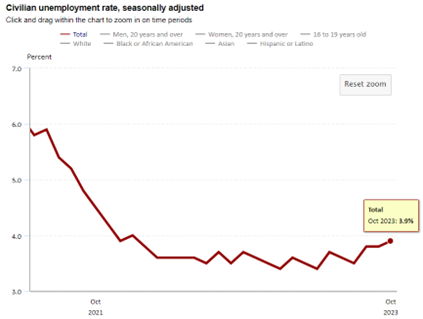

Why? Because this morning’s October jobs report suggested we’re on track for a “soft landing” in the economy. Job growth slowed to 150,000 in October, below forecasts for 180,000, while unemployment ticked up to 3.9%, above the 3.8% forecast. Average hourly earnings growth came in at +0.2%, a bit weaker than the +0.3% forecast.

Source: Bureau of Labor Statistics

Remember: The Federal Reserve wants to see evidence the labor market is cooling so it can stay on “pause” with interest rates. Wall Street wants to see evidence the economy is cooling, but not collapsing, because that means the Fed will get out of the picture yet corporations can still generate decent profits. Today’s numbers – and others we’ve gotten recently – suggest things are on track. Hence the major rally this week.

In other news, Sam Bankman-Fried was convicted on all fraud and conspiracy charges in a New York City courtroom yesterday. The founder of the FTX cryptocurrency exchange faces a maximum sentence of 110 years in prison, though sentencing won’t be for a while and he’s likely to appeal. It was a stunning fall from grace for the former poster boy for crypto, altruistic capitalism, and the meshing of the worlds of finance, sports, and celebrity.