Stocks are continuing to edge higher, defying all the doom and gloom talk that was prevalent in October. The Nasdaq Composite just logged its first eight-day streak of gains since November 2021, while the S&P 500 rose for its seventh day in a row.

Equities are muted so far this morning, as are gold and silver. Crude oil was recently off around a percent, while the dollar and Treasuries are mostly flat.

Could home buyers FINALLY be catching a break? The average rate on a 30-year fixed mortgage dropped to 7.61% from 7.86% in the most recent week, the biggest such decline in more than a year. The Mortgage Bankers Association reported a modest 3% rise in applications for loans to purchase homes. Its lending index has been hovering around quarter-century lows.

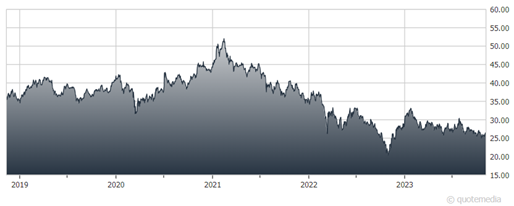

Investors who rolled the dice on the stock market of the world’s second-largest economy have come up snake eyes. Now, they’re taking their money off the table. Global investors have yanked $1.6 billion from funds that invest in China so far this year, according to the Wall Street Journal. Total assets in China-focused funds have shrunk to $21.6 billion, down 33% from the 2021 peak of $32.3 billion.

iShares China Large-Cap ETF (FXI)

This long-term chart of the iShares China Large-Cap ETF (FXI) speaks volumes. It has lost 29% of its value in the last half-decade. The SPDR S&P 500 ETF (SPY) has GAINED 69% during the same time period. Still, as you’ll see in today's newsletter below, at least one of our MoneyShow contributors thinks other Asian markets are turning a corner shorter-term – offering investors potential upside.

Finally, Israel said overnight that its forces pushed into the heart of Gaza City roughly two weeks after its troops poured across the border into the Gaza Strip. The invasion was retaliation for Hamas’ deadly attacks on Oct. 7, and so far, Israel has resisted increasing global calls for a cease fire and/or a “humanitarian pause” in its operations.