Stocks rallied strongly into the close on Friday, but they’re starting the week off with a bit of a pullback. Most other markets are flattish, including Treasuries, crude oil, and the dollar.

The countdown is on to the meeting between President Biden and Chinese leader Xi Jinping. They will have a face-to-face meeting in San Francisco, where everything from trade to Taiwan will likely be on the table. Business leaders and Wall Street will be closely watching for signs of a thaw in relations, considering US-China trade totaled a whopping $760 billion in 2022 and both countries’ economies are linked in a myriad of ways.

Bearishly inclined credit analysts have focused on commercial real estate (CRE) as a key source of trouble for lenders. Now, the Wall Street Journal reports that foreclosures on so-called mezzanine loans in the CRE sector are soaring.

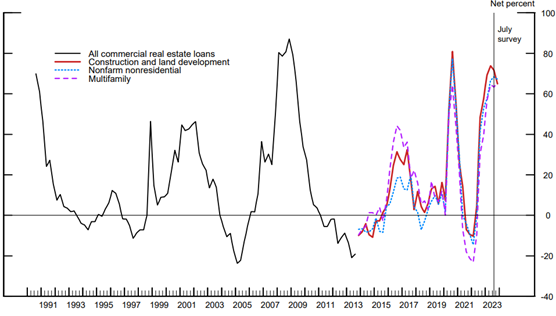

Mezzanine loans are somewhat akin to second mortgages in the housing market. They helped bridge financing gaps for property owners that couldn’t get enough money from first-position CRE lenders. With office vacancies rising and rents under pressure, lenders are getting stingier in the CRE space. This chart from the Federal Reserve’s most recent Senior Loan Officer Opinion Survey (SLOOS) shows that more banks are tightening standards on CRE loans now than at almost any other point on record.

Finally, if you’re a retiree, you actually get a BENEFIT from rising interest rates...sort of. As Morningstar notes, you can (theoretically) take out more money from your retirement fund than you previously could because higher yields on your savings give you more flexibility. The firm estimates the “safe withdrawal rate” on a traditional retiree portfolio has risen to 4% from 3.8%.