Stocks are taking an early breather after a Dow-led rally yesterday. But Treasuries, gold, and silver are tacking on more gains. The dollar and crude oil are lower.

President Biden and Chinese leader Xi Jinping held their closely choreographed meeting at the Filoli Mansion grounds south of San Francisco yesterday. Xi also hosted a dinner with US business leaders where he emphasized how the US and China could work together on economic issues. Leaders of companies like Apple (AAPL), BlackRock (BLK), Boeing (BA), and Tesla (TSLA) either attended the dinner or made appearances there.

Observers didn’t expect any major breakthroughs from the summit, and none were announced. We did get some modest measures designed to curb Chinese fentanyl ingredient supply and others to enhance military-to-military communications. Xi reportedly complained about US restrictions on exports of key technology to China, while Biden pushed back against Chinese interference in Taiwan’s affairs.

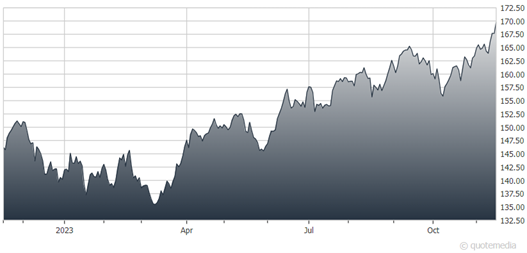

Walmart (WMT)

Meanwhile, retailers are releasing their latest round of results a week ahead of Thanksgiving and Black Friday. While Walmart (WMT) slightly topped third-quarter profit and revenue estimates, CEO Doug McMillon warned that consumers were being more cautious with their spending. Same store sales also rose just 4.7%, down from last year’s 8.5% gain. WMT shares have performed well this year, rising more than 19%. But they’re trading lower in the early going.

Economic data also continued to trickle in today, with import and export prices falling more than expected in October. Initial jobless claims filings also rose to 231,000 in the most recent week, notably above the 220,000 that was expected. The key takeaway from the latest numbers remains as follows: The Federal Reserve is DONE for 2023...and probably the entire interest rate cycle.