Bonds and bullion have been the name of the game lately, with both assets seeing a powerful move higher this month. They’re taking a breather in the early going here, though. The same can’t be said for stocks. They’re trading higher after a flat Wednesday. Crude oil and the dollar are higher.

You know how I wrote yesterday that November has been the best month for the bond market since 2008? Well, Bloomberg now says some added momentum in the last 24 hours makes this the best month since the 1980s!

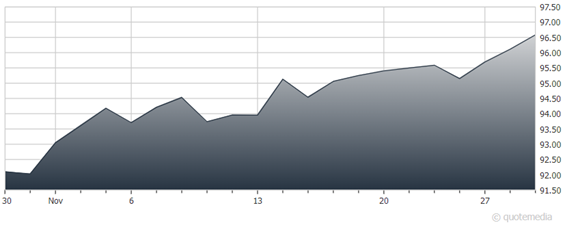

Yields on the benchmark 10-year Treasury Note dropped another 6+ basis points yesterday, helping extend an “everything rally” in all kinds of assets that had been under pressure due to rising rates and tighter Federal Reserve policy. The iShares Core US Aggregate Bond ETF (AGG) rose another 0.5% in price yesterday, boosting its month-to-date gains to around 5%. Gold futures have risen around $125 an ounce from their Nov. 10 low.

iShares Core US Aggregate Bond ETF (AGG)

Today is the big Cybertruck launch day for Tesla (TSLA). Sure, it’s about two years later than expected. Sure, building the stainless steel exterior has proven to be a major pain in the neck. And sure it faces stiff competition from competing trucks sold by Ford Motor (F) and General Motors (GM). But investors, analysts, and early adopters will be watching the Austin, Texas rollout event later today to see details on pricing, features, and more. Dare I say...buckle up?

Finally, members of the OPEC+ alliance of oil producers are meeting to figure out a strategy for 2024. Saudi Arabia has tried to curb global supply by leading multiple rounds of output cuts, but slowing demand and rising US production has offset those moves. Result: Crude oil prices remain soft, down about 2% year-to-date. For its part, the Energy Select Sector SPDR Fund (XLE) is mostly treading water in 2023, off around 1%.