“Jobs Fridays” are notoriously tricky to trade, with a ton of intraday volatility. We’ve already seen that this morning following the latest data, with stocks selling off big at 8:30 am Eastern, then clawing their way back.

Crude oil is notably higher, while gold and silver are a bit lower. Treasuries are down in price, while the dollar is up.

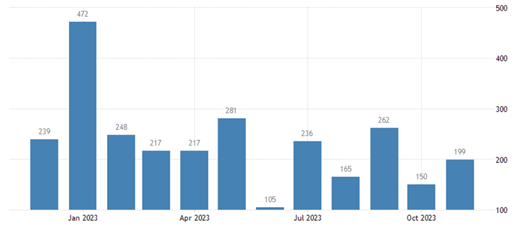

After a couple of weaker labor market reports earlier this week, Wall Street was eagerly awaiting today’s employment figures for November. Economists expected a gain of 180,000 jobs, an unemployment rate of 3.9%, and an increase in average hourly earnings of 0.3%. The actual numbers? Plus-199,000..3.7%...and plus-0.4%.

That definitely bucked the recent data trend, hurting markets a bit. That’s because we’re in a “bad news is good news” market, where softer (but not TOO soft) data increases the chance of future Federal Reserve rate cuts. Wall Street likes nothing more than cheaper money. But I doubt the weakness will last too long because other data suggests the “soft landing” thesis is on track.

Change in Nonfarm Payrolls by Month

Source: Tradingeconomics.com

In other news: Some of our most accomplished experts, including Mobius Capital Partners Co-Founder Mark Mobius, have talked about the investment opportunities in India. They feel the economic and corporate opportunities there are bright, and it looks like Apple (AAPL) agrees.

The tech giant plans to assemble more than 50 million iPhones in the country annually through 2026. That would make India responsible for roughly a quarter of the smartphones produced globally by the end of the decade. The step is another example of multinational firms looking to reduce their reliance on China as a manufacturing center.