Stocks liked what they heard on the inflation front this morning, but after an initial post-data pop, they’re back to around flat. Gold and silver are also bouncing back, while crude oil is modestly lower along with the dollar. Treasuries are mostly flat.

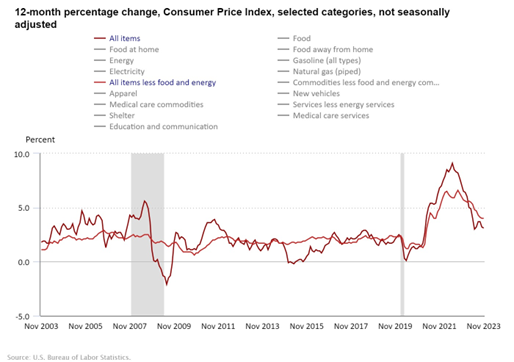

Today is “Inflation Day” – so what did the latest Consumer Price Index data show? No surprises. The headline CPI rose 0.1% in November, while the core gained 0.3%. That matched forecasts on both counts. On a year-over-year basis, inflation is running at +3.1% (headline) and +4% (core).

Markets were okay with the numbers because they confirm A) The Federal Reserve won’t be hiking rates at the meeting that concludes tomorrow and B) Inflation is continuing to drop from peak levels, which COULD lead to rate cuts next year.

CPI YOY % Change (Headline and Core)

If at first you don’t succeed, try going hostile? That’s the playbook Choice Hotels (CHH) is using with Wyndham Hotels & Resorts (WH) after the latter refused to close a friendly merger transaction. Choice has already bought 1.5 million WH shares, worth about $110 million, and it’s now going directly to other shareholders to see if they’ll vote to approve a takeover. The two firms would capture roughly 17% of the US hotel market if they can push the deal over the finish line.

Alphabet (GOOGL) lost a San Francisco court battle with Epic Games, a development that could have significant impacts on how it and Apple (AAPL) charge for access to their respective app stores. Since Google and Apple effectively have a duopoly, they can charge developers up to 30% commissions for any in-app purchases and subscription agreements customers execute. Fortnite-developer Epic pushed back. The legal victory will likely lead to better deal economics for app developers – and possibly lower prices for consumers.