Stop me if you’ve heard this one before: The stock market enjoyed a nice, late-day rally yesterday, with the averages all adding to their 2023 gains. They’re giving back a bit of ground in the early going today, though. Crude oil is higher along with Treasuries and the dollar, while gold and silver are mixed.

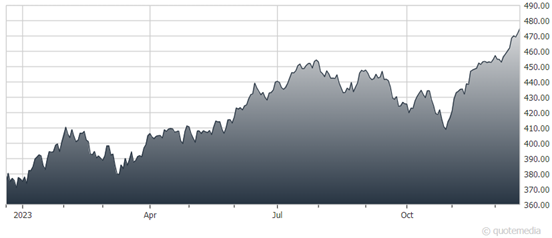

The S&P 500 is doing its best impersonation of The Little Engine That Could, saying “I think I can, I think I can” as it closes in on its all-time high of 4,796. That record was set in January 2022, and the S&P can breach it with a push of less than 1%. The index is already up 25% YTD.

S&P 500 ETF Trust (SPY)

A key driver of the rally? The market’s expectation that some of the aggressive Federal Reserve rate hikes from the past year and a half will be reversed in 2024. Fed officials are divided on when, and by how much, they might cut rates. That’s because they don’t know how soon, or how quickly, inflation will drop toward their 2% target.

It’s likely Fed officials will keep “wrestling” with traders eager to front-run any cuts. In other words, they’ll use speeches and media appearances to encourage patience and to underscore that cuts aren’t a foregone conclusion – especially aggressive ones.

Lastly, major shipping companies are warily re-routing vessels away from the Red Sea to avoid drone and missile attacks. Houthi rebels operating from Yemen and backed by Iran have been launching attacks on commercial ships transiting the waterway.

The US has pledged to use warships to defend the region, but some cargo and energy shippers are choosing to sail around the tip of Africa rather than through the Red Sea and Suez Canal to avoid potential damage and casualties regardless. That could put upward pressure on transportation and energy costs in the weeks and months ahead.