Stocks staged an impressive late-day rebound yesterday, though they’re down a bit this morning. More important is the action in GOLD. The yellow metal is trying to punch through to all-time highs in the early going, extending its one-month rally to almost 4%. Crude oil is up a bit, while Treasuries are flat, and the dollar is a bit weaker.

This morning, we got our last major helping of economic data before the holidays. Personal income rose 0.4% in November while personal spending gained 0.2%, compared with forecasts of +0.4% and +0.3%. Durable goods orders blew past expectations at +5.4%.

But most importantly, the Personal Consumption Expenditures (PCE) gauge of inflation FELL 0.1% on the headline and rose just 0.1% on the core. Those November numbers were cooler than forecast. They add to evidence the Federal Reserve is getting what it wants on the inflation front, which means it will likely shift to cutting rates in 2024.

So...let’s talk about gold. Many of our MoneyShow experts have laid out a bullish case for gold, silver, and mining shares, as you can read here. The big drivers: A) The Fed’s likely “pivot” on rates in the new year and B) The knock-on effects that will have on the dollar and the “easy-ness” of money.

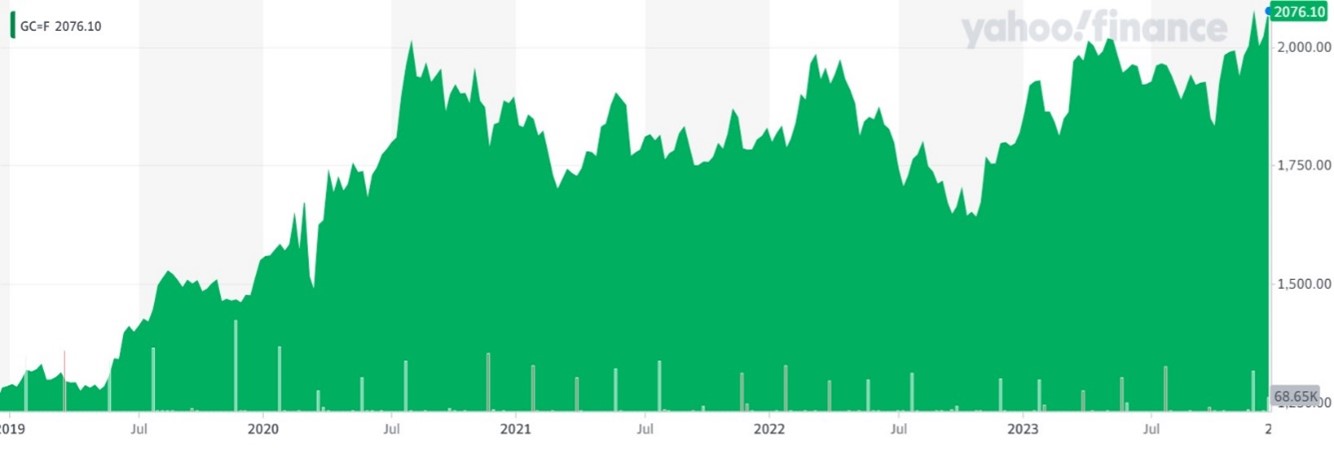

You can see in this five-year chart of gold that the metal appears to be breaking out of a massive consolidation pattern. The SPDR Gold Shares (GLD) was up about 11% year-to-date recently, while the VanEck Gold Miners ETF (GDX) has climbed more than 9% in the last month.

Gold Futures

Lastly, on the M&A front, Bristol-Myers Squibb (BMY) said it would scoop up Karuna Therapeutics (KRTX) for around $14 billion. KRTX has been developing a schizophrenia treatment called KarXT that is currently being reviewed by the Food and Drug Administration (FDA). BMY hopes to push further into the neuroscience drug market with the deal.