Stocks recoiled again yesterday on renewed Federal Reserve concerns, though they’re trying to steady themselves this morning. Treasuries are down a bit, while gold, silver, and the dollar are mostly flat and crude oil is modestly higher.

Turns out stock AND bond investors don’t really like hints the Fed won’t be as aggressive as hoped in pivoting to rate cuts. The release yesterday of minutes from the Fed’s December meeting helped fuel another late day sell off, in part because they suggested some policymakers think it “would be appropriate for policy to remain at a restrictive stance for some time until inflation was clearly moving down sustainably toward the Committee’s objective.”

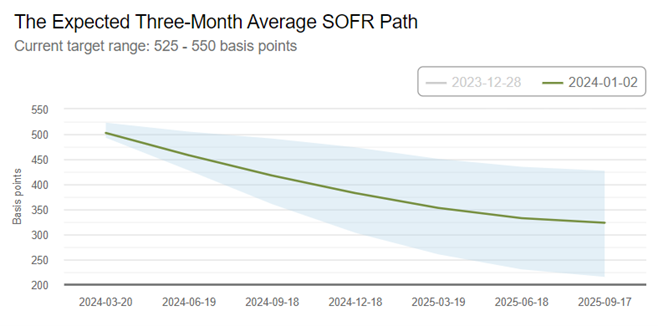

Rate futures traders are now pricing in a roughly 62% chance of an initial 25-point rate cut at the Fed’s March 19-20 meeting. That’s down from 73% odds at the end of 2023, according to the CME FedWatch Tool. Still, markets are currently expecting short-term rates to fall from the current 5.25%-5.50% target range to around 3.75% by year end and 3.25% in 2025, as you can see in this Atlanta Fed chart.

Source: Federal Reserve Bank of Atlanta

In other news, cookies are going away. No, not the ones Santa Claus didn’t eat on Christmas morning. The “cookies” that the Internet ecosystem uses to track your browsing and clicking activity so advertisers can serve you with more relevant ads.

Alphabet (GOOGL) wants to replace them with newer technology for its Chrome browser users, though many advertisers say the $600 billion online ad industry isn’t ready for the shift. The elimination process will span most of 2024.