Stocks slid earlier this morning before trading mixed after strong jobs data rekindled concerns about Federal Reserve policy. More in a minute. Meanwhile, gold, silver, the dollar, and Treasuries have also been swinging wildly. Crude oil was recently up modestly.

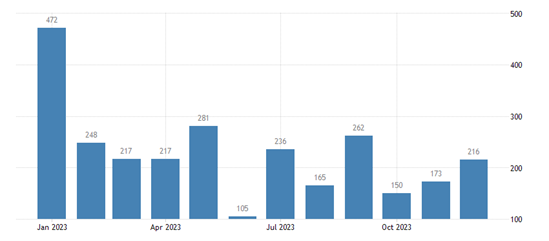

“Jobs Friday” days can be tricky, with initial moves not always the same ones we see later in the day. But in the early going, stocks lurched lower when we learned the US economy created 216,000 jobs last month, while the unemployment rate slipped to 3.7% and average hourly earnings rose 0.4%. That was a LITTLE hot relative to expectations of +170,000, 3.8%, and +0.3%.

Source: Tradingeconomics.com

Why the sad faces on Wall Street? Stronger data means the Fed may not cut interest rates as much or as soon as markets were hoping. And as markets de-price future cuts, it puts some pressure on stock valuations. Still, the data looks “soft landing-ish” to me – and in the longer-term, that’s positive.

How much inflation is TOO much inflation? Apparently, what snack and soda giant PepsiCo (PEP) has been cooking up!

The European retail giant Carrefour decided it was sick and tired of all the price hikes PepsiCo was trying to push through for its Lay’s potato chips, Pepsi soda, Quaker cereals, and other products. So, it stopped selling several in its grocery stores – and put up plenty of signs telling shoppers the fracas was Pepsi’s fault. PepsiCo said it would “continue to engage in good faith in order to try to ensure that our products are available.”